Mumbai, 6th August 2025: Raymond Limited today announced its unaudited financial results for the quarter ended 30th June 2025.

Mumbai, 6th August 2025: Raymond Limited today announced its unaudited financial results for the quarter ended 30th June 2025.

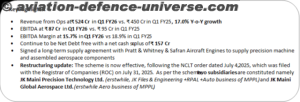

| Particulars (₹ Cr.) | Q1 FY26 | Q4 FY25 | Q1 FY25 | YoY |

| Revenue from operations | 524 | 557 | 450 | 17% |

| Other income | 31 | 44 | 50 | (38%) |

| Total Income | 555 | 601 | 500 | 11% |

| EBITDA | 87 | 99 | 95 | (8%) |

| EBITDA Margin % | 15.7% | 16.4% | 18.9% | |

| PBT (before exceptional items) | 30 | 45 | 44 | (31%) |

| PBT Margin (before exceptional items) | 5.4% | 7.4% | 8.8% |

Note: Raymond Limited now includes two subsidiaries -1) Aerospace & Defence and 2) Precision Technology & Auto Components.

Raymond Limited continued its growth momentum, delivering a healthy performance with Revenue from operations of ₹ 524 Cr, reflecting a 17.0% increase compared to the same quarter of the previous financial year. Raymond Limited delivered an EBITDA of ₹ 87 Cr with an EBITDA margin of 15.7% in Q1FY26, marginally lower compared to last year as Other Income reduced in Raymond Limited on account of demerger of the Real Estate Business in this quarter. This performance was on the back of strong performance from both Aerospace & Defence and Precision Technology segments. Going forward we remain optimistic for the future growth trajectory, given our expansion strategy in new product categories and new geographies.

Commenting on the performance, Gautam Hari Singhania, Chairman & Managing Director, Raymond Limited said; “We’re delighted to announce signing of two strategic, long-term supply agreements with Pratt & Whitney and Safran Engines. These landmark partnerships will see us supply complex precision-machined and assembled components, underscoring our unwavering commitment to excellence and significantly bolstering our global presence in aerospace manufacturing. Our auto component and engineering consumables business also had a strong quarter, demonstrating robust performance in a competitive market. Overall, we are well-positioned to capitalize on opportunities across both our subsidiaries, ensuring sustained value delivery to our stakeholders.”

Q1FY26 Segmental Performance

Aerospace & Defence Business:

In Q1 FY26, this segment generated ₹ 87 crore in revenue, a 37% increase from ₹ 64 crore in Q1 FY25. EBITDA also grew significantly by 30%, reaching ₹ 21 crore compared to ₹ 16 crore in Q1 FY25. The EBITDA margin stood at 23.7% for the quarter, compared to 25.1% in Q1 FY25.

We continue to experience robust growth, driven by increasing interest from potential clients through Requests for Quotation (RFQs) and the exploration of new collaborative opportunities.

Precision Technology & Auto Components:

In Q1 FY26, this segment generated ₹ 398 crore in revenue, a 12% increase from ₹ 355 crore in Q1 FY25. EBITDA also grew by 8%, reaching ₹ 42 crore compared to ₹ 39 crore in Q1 FY25. The EBITDA margin stood at 10.6% for the quarter, a slight decrease from 11.0% in Q1 FY25.

During the quarter, our Tools and Hardware business further boosted its sales through expansion into new international geographies and industrial sectors We are observing business momentum across domestic and international markets, supported by China-plus one strategy, integration synergies, and focused operational efficiencies across all segments.

Raymond Limited continues to remain net-debt free company with net cash surplus of ₹ 157 Cr.