Low oil prices and proactive government policies provide the right push

Hyderabad, 17 March 2016 – With 81 million trips, India’s domestic aviation market grew at over 20.3% during Jan-Dec 2015 – the highest growth rate recorded in the world. India is well on its way to become the third largest aviation market by 2020 says the FICCI-KPMG ‘India Aviation Report 2016’, launched today at the prestigious civil aviation exposition in Hyderabad.

The report suggests that aspects such as increasing disposable incomes, fall in prices of Aircraft Turbine Fuel (ATF), increase in tourism, visa reforms, etc. have placed India in a unique position. This is bringing the country closer to achieving its vision of becoming the largest aviation market by 2030.

The civil aviation sector is hugely susceptible to oil price volatility, economic cycles, natural disasters, epidemics and political upheavals. According to the report, the Indian civil aviation industry has exhibited tremendous resilience to the global economic slowdown and ranks ninth in the global civil aviation market. This is attributed largely to the growing economy, increased competition among airlines, especially among low cost carriers, modern airports, greater use of technology, Foreign Direct Investment (FDI) and increased emphasis on regional connectivity.

The report highlights that the National Civil Aviation Policy (NCAP 2016) is likely to provide a significant fillip to the industry. The various fiscal and monetary incentives, liberal policies focused on ‘ease of doing business’ and enhanced push for regional and global connectivity are extremely positive.

Steps taken to revive and operationalise around 160 airports in India, if chosen carefully, will improve air connectivity to regional and remote areas. Public-Private Partnerships (PPP) in the sector will get substantial support from the state in terms of financing, concessional land allotment, tax holidays and other incentives.

According to Harshavardhan Neotia, President, FICCI, “Enormous growth in domestic passenger traffic, substantial strengthening through Government initiatives, decrease in global crude oil prices and airlines showing profits indicates a significantly positive transformation for the Indian civil aviation market. The close partnership between the government and the industry in ongoing and future projects will further improve regional connectivity. I am certain that the sector will take complete advantage of the positive momentum and help sustain the growth”

Amber Dubey, Partner and India Head of Aerospace and Defence, KPMG said, “The positive impact of NCAP 2016, rise in disposable incomes and the fall in ATF prices are likely to help India leapfrog into the top three of the world. One hopes that the government can match domestic ATF prices with global levels for a three year experimental period. MRO is likely to see a huge revival if the service tax is zero-rated. Growth of aviation and tourism can create a huge multiplier in terms of GDP growth and jobs.”

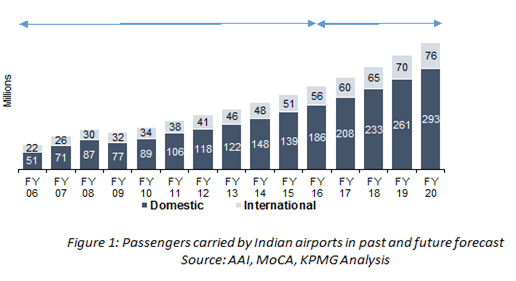

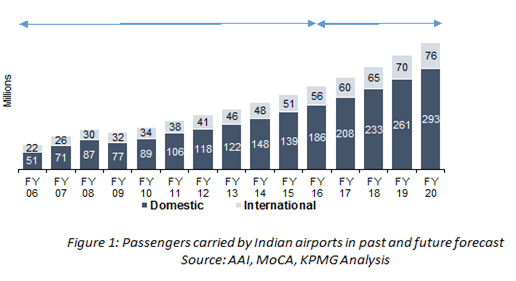

The report sheds light on the astounding growth of 17.1% in the total passenger throughput for FY 2015-16 till January 2016 standing at 184 million. Passenger throughput is expected to reach around 370 million by 2020, with domestic traffic constituting around 80% of the total throughput (figure 1)

According to International Air Transport Association (IATA), passenger traffic on international routes showed an increase of 6.5% in 2015 compared to 2014. In comparison, during Apr-Dec 2015, international passenger throughput at Indian airports grew at 7.7%. Middle East continues to lead in the growth of revenue passenger kilometre (RPKM) followed by Asia-Pacific, Latin America and Europe. North America and Africa showed sluggish growth. By 2034, it is expected that Asia-Pacific will be the biggest market for global aviation.

The report strongly suggests that in order to ensure high-geared growth, it is imperative to broaden the base of domestic flyers through greater air connectivity in Tier 2/3 cities. Many Indian states have taken positive initiatives, largely in the field of development of airports, reduction in sales tax rates on ATF and direct subsidy to airlines for improvement of connectivity.

The government and industry are engaged closely in addressing the various opportunities and challenges in the aviation sector; and that’s a welcome sign. The collaboration needs to be strengthened and institutionalised. With positive macro-economic factors, low ATF prices and industry-friendly government policies, India is well placed to achieve its vision of becoming the third largest aviation market by 2020 and the largest by 2030.