Los Angeles, California. 05 August 2021. Air Lease Corporation (ALC) (NYSE: AL) announces financial results for the three and six months ended June 30, 2021.

“On an overall global scale, the airline industry is improving. Passenger traffic is staging a robust recovery in the U.S.A., Mexico, China, Russia, and most of Europe, with international and long haul traffic at a much slower recovery rate. Outside of China, Asia overall lags in traffic recovery and vaccination rates. Although we still face some customer and OEM challenges in the near term, our operating cash flow continues to strengthen. Lease placements from our fleet and orderbook are accelerating as airlines view recovery and the desirability of fleet transformation to enhance operating economics and environmental sustainability,” said John L. Plueger, Chief Executive Officer and

President.

“Pent up demand is resulting in rapid and strong recovery when and where travel restrictions are lifted. Accordingly, we are focusing our leasing efforts on the most rapidly recovering regions, such as growing our U.S.A. book of business, where we see more potential ahead. Canada opening its borders should provide a further stimulant to North America, while we anticipate trans-Atlantic traffic recovery in the near future. Strong freight and e-commerce demand is aiding airline recovery globally, which is particularly beneficial for our widebody customers in Asia and Europe. We continue to see a bright future for ALC in providing for the growing demands of commercial aviation,” said Steven F.

Udvar-Házy, Executive Chairman of the Board.

Second Quarter 2021 Results

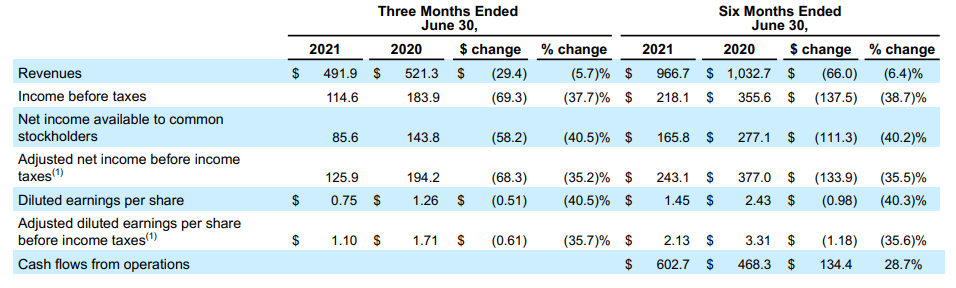

The following table summarizes our operating results for the three and six months ended June 30, 2021 and 2020 (in millions, except per share amounts and percentages):

Financial Highlights

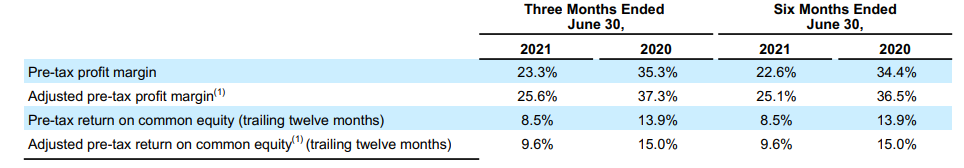

Financial Ratios

- Adjusted net income before income taxes, adjusted diluted earnings per share before income taxes, adjusted pre-tax profit margin and adjusted pretax return on common equity have been adjusted to exclude the effects of certain non-cash items, one-time or non-recurring items, that are not expected to continue in the future and certain other items. See note 1 under the Consolidated Statements of Income included in this earnings release for a discussion of the non-GAAP measures and a reconciliation to their most comparable GAAP financial measures.

Second Quarter 2021 Highlights

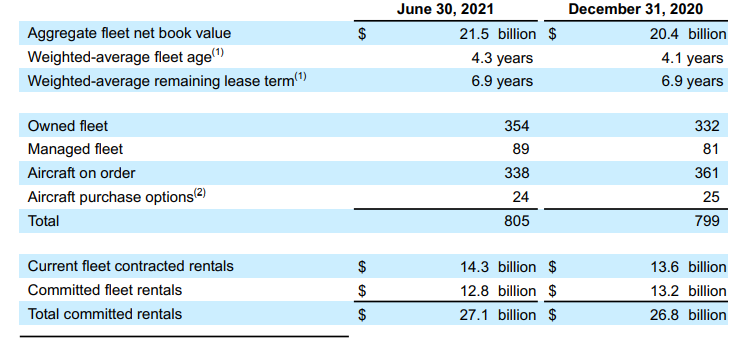

- Took delivery of 12 aircraft from our orderbook, representing $971 million in aircraft investments. As of June 30, 2021, we owned 354 aircraft in our operating lease portfolio with a net book value of $21.5 billion, a weighted average age of 4.3 years and a weighted average lease term remaining of 6.9 years.

- Placed 93% of our contracted orderbook positions on long-term leases for aircraft delivering through the end of 2022 and 80% through the end of 2023.

- Ended the quarter with $27.1 billion in committed minimum future rental payments consisting of $14.3 billion in contracted minimum rental payments on the aircraft in our existing fleet and $12.8 billion in minimum future rental payments related to aircraft on order.

- To date, 52% of the lease deferrals granted have been repaid, representing $126.9 million. This contributed to the 29% increase in our operating cash flow for the six months ended June 30, 2021.

- Issued $1.8 billion in aggregate principal amount Medium-Term Notes consisting of $1.2 billion at a fixed rate of 1.875% due 2026 and $600.0 million at a floating rate of three-month LIBOR plus 0.35% due 2022.

- In July 2021, Fitch Ratings reaffirmed our corporate and long-term debt ratings at BBB and upgraded our outlook to stable.

- Declared a quarterly cash dividend of $0.16 per share on our outstanding Class A common stock for the second quarter of 2021. The dividend will be paid on October 8, 2021 to holders of record of our common stock as of September 10, 2021.

Financial Overview

Our total revenues for the three months ended June 30, 2021 decreased by 5.7% to $491.9 million compared to the three months ended June 30, 2020. Despite the continued growth of our fleet, we were not able to recognize $41.6 million of rental revenue during the three months ended June 30, 2021, because lease receivables exceeded the lease security package held and collection was not reasonably

assured for certain leases, of which $27.9 million was related to Vietnam Airlines, with whom we are working towards a resolution. In addition, we entered into lease restructurings, which typically included lease extensions, that resulted in a decrease of approximately $45.1 million in revenue for the quarter ended June 30, 2021. These decreases in revenue were partially offset by an increase in other

revenues of $34.0 million recognized in connection with the sale to a third party of certain unsecured claims related to insolvency proceedings for Aeromexico. Our net income available to common stockholders for the three months ended June 30, 2021 was $85.6 million compared to $143.8 million in 2020. Our diluted earnings per share for the three months ended June 30, 2021 was $0.75 compared to $1.26 for the three months ended June 30, 2020. The decrease in net income available to common stockholders was primarily due to the decrease in revenues as discussed above and an increase in depreciation and interest expense from the growth of our fleet.

Impact of COVID-19 Update

The impact of the COVID-19 pandemic to our business includes, among other things, the following:

- As of August 5, 2021, we have agreed to accommodations with approximately 63% of our lessees. To date, we have agreed to defer $241.9 million in lease payments, of which $126.9 million or 52% of the total deferral amount has been repaid. As of August 5, 2021, our total deferrals, net of repayments, was $115.0 million. Our net deferrals represented approximately 1.5% of our total available liquidity as of June 30, 2021. We have also entered into some lease restructurings. The impact of these restructurings

resulted in a decrease in total revenues of $45.1 million for the three months ended June 30, 2021 as compared to the three months ended June 30, 2020. - Our collection rate(1) for the three and six months ended June 30, 2021 was 87% and 86%, respectively. We expect that our collection rate will remain under pressure due to the impact of COVID-19. As lease receivables exceeded the lease security package held and collection was not reasonably assured with certain lessees, we did not recognize rental revenue of $41.6 million and $90.3 million for the three and six months ended June 30, 2021, respectively. Aircraft on lease with these lessees represented approximately 10.9% of our fleet by net book value as of June 30, 2021 as compared to 7.8% as of December 31, 2020.

- Our Lease Utilization Rate(2) for the quarters ended June 30, 2021 and March 31, 2021 was 99.7% and 99.6%, respectively.

Given the dynamic nature of this situation, we cannot reasonably estimate the continued impacts of COVID-19 on our business, results of operations and financial condition for the foreseeable future. See “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021 for further discussion on the Impact of COVID-19.

- Collection rate is defined as the sum of cash collected from lease rentals and maintenance reserves, and includes cash recovered from outstanding receivables from previous periods, as a percentage of the total contracted receivables due for the period. The collection rate is calculated after giving effect to lease deferral arrangements made as of June 30, 2021. We define liquidity as unrestricted cash plus the available borrowing capacity under our RevolvingvCredit Facility.

- The Lease Utilization Rate is calculated based on the number of days each aircraft was subject to a lease or letter of intent during the period, weighted by the net book value of the aircraft.

Flight Equipment Portfolio

Our owned fleet grew by 5.6% to a net book value of $21.5 billion as of June 30, 2021 compared to $20.4 billion as of December 31, 2020. As of June 30, 2021, our fleet was comprised of 354 aircraft in our operating lease portfolio, with a weighted-average age and a weightedaverage remaining lease term of 4.3 years and 6.9 years, respectively, and 89 managed aircraft. As of June 30, 2021, we had a globally

diversified customer base of 115 airlines in 59 countries.

During the quarter ended June 30, 2021, we took delivery of 12 aircraft from our orderbook. Approximately 74% of the net book value of our fleet were leased to flag carriers or airlines that have some form of governmental ownership.

We and airlines around the world have continued to experience delivery delays from Boeing and Airbus and have been impacted by ongoing manufacturer delays due to the COVID-19 pandemic, delays related to the grounding of the Boeing 737 MAX, temporary suspension of Boeing 787 deliveries, and pre-pandemic Airbus delays that remain ongoing. These delays and the ongoing COVID-19 pandemic have also impacted passenger growth and airline profitability and we expect this to continue. As a result of continued manufacturing delays and the impact of COVID-19, our aircraft delivery schedule could continue to be subject to material changes and delivery delays could potentially

extend well into 2022 and beyond.

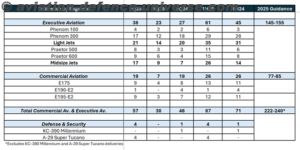

The following table summarizes the key portfolio metrics of our fleet as of June 30, 2021 and December 31, 2020:

- Weighted-average fleet age and remaining lease term calculated based on net book value of our operating lease portfolio.

- As of June 30, 2021 and December 31, 2020, we had options to acquire up to 24 and 25 Airbus A220 aircraft, respectively.

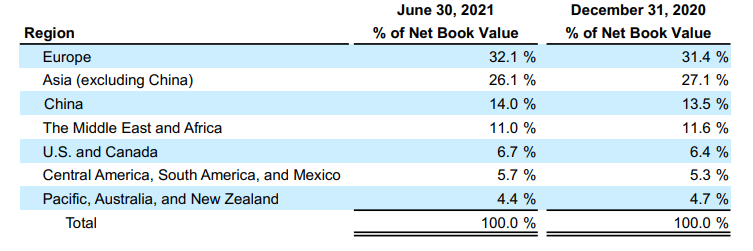

The following table details the regional concentration of our flight equipment subject to operating leases:

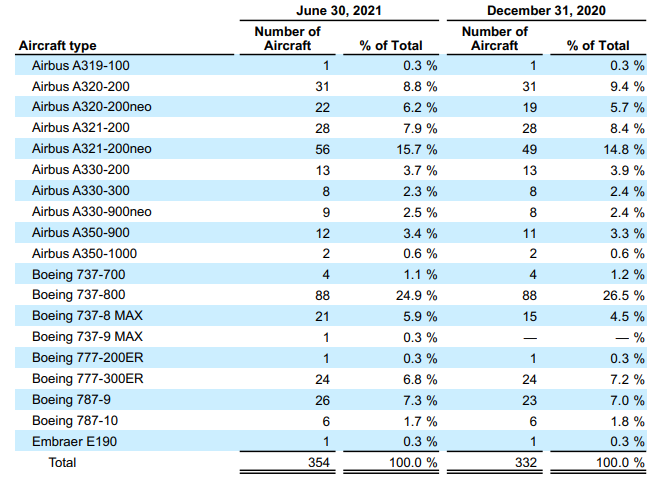

The following table details the composition of our flight equipment subject to operating leases by aircraft type:

Debt Financing Activities

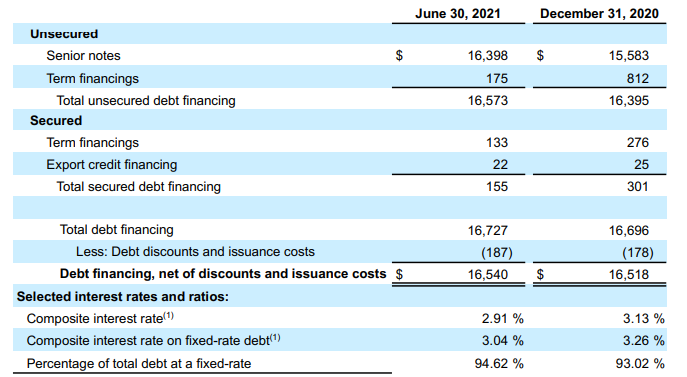

We ended the second quarter of 2021 with total debt financing, net of discounts and issuance costs, of $16.5 billion, with a debt to equity ratio of 2.54:1 and available liquidity of $7.6 billion. During the three months ended June 30, 2021, we issued $1.8 billion in aggregate principal amount of Medium-Term Notes consisting of $1.2 billion at a fixed rate of 1.875% due 2026 and $600.0 million at a floating rate of three-month LIBOR plus 0.35% due 2022.

In April 2021, we entered into an amendment to increase the capacity on our Revolving Credit Facility to $6.4 billion and extended the final maturity to 2025.

As of the end of the periods presented our debt portfolio was comprised of the following components (dollars in millions):

- This rate does not include the effect of upfront fees, facility fees, undrawn fees or amortization of debt discounts and issuance costs.

Conference Call

In connection with this earnings release, Air Lease Corporation will host a conference call on August 5, 2021 at 4:30 PM Eastern Time to discuss the Company’s financial results for the second quarter of 2021.

Investors can participate in the conference call by dialing (855) 308-8321 domestic or (330) 863-3465 international. The passcode for the call is 2778579.

The conference call will also be broadcast live through a link on the Investor Relations page of the Air Lease Corporation website at www.airleasecorp.com. Please visit the website at least 15 minutes prior to the call to register, download and install any necessary audio software. A replay of the broadcast will be available on the Investor Relations page of the Air Lease Corporation website.

For your convenience, the conference call can be replayed in its entirety beginning at 7:30 PM ET on August 5, 2021 until 7:30 PM ET on August 12, 2021. If you wish to listen to the replay of this conference call, please dial (855) 859-2056 domestic or (404) 537-3406 international and enter passcode 2778579.