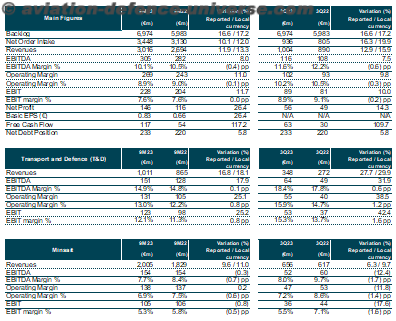

- The backlog and order intake grew at double-digit rates in the first nine months of 2023, with the backlog once again posting record highs

- Revenues increased by 12% in the first nine months of the year, with a significant acceleration of Defence income in the third quarter, recording a 39% increase with respect to the third quarter of 2022

- The net order intake rose and revenue in 3Q23 grew at a double-digit rate compared to 3Q22

- The reported EBIT for the first nine months of 2023 also rose by 12% in relation to the same period of 2022

- The net earnings per share increased by 26% in the first nine months of 2023 compared to the same period of the previous year

- The free cash flow (FCF) totaled €117 M vs. €54 M in the same months of 2022

- All of the financial targets for 2023 (revenues, EBIT and FCF) that were increased by the company in July have been reiterated

- Indra acquires a 9.5% stake in ITP and a 30% stake in Epicom. The companies Park Air and Nae in ATM and Minsait were also acquired

Madrid, October 31, 2023.-

According to Indra chairman Marc Murtra, “We’re aware of and we’ve internalized the disruptive changes that are on their way in the field of technology and we’re preparing to address this new era. We’re already making key changes and placing a strategic focus on segments with higher value and growth”.

In reference to the financial results, Indra’s CEO, José Vicente de los Mozos, stated that, “We should congratulate ourselves on the results in the first nine months of the year. The data show that we’re continuing to grow profitably and sustainably as we enhance our technological leadership. This will enable us to further Indra’s transformation, which will culminate in the Leading the Future Strategic Plan. I’m highly satisfied with the dynamics of the construction of the plan, as well as the teams’ contribution to it. We’ll have the chance to present it during the first quarter of the year and it will constitute a new phase for Indra”.

Main features

Revenues in the first nine months of 2023 rose by 13% in local currency (12% in reported terms) in comparison with the same period of the previous year.

- Revenues from the Transport & Defence division grew by 18% in local currency, due to the sharp rise in Defence & Security (29% in local currency) and the greater contribution of the FCAS and Eurofighter projects, as well as Air Traffic (25% in local currency), with solid activity in all of the geographical areas, especially Spain, Belgium, Panama, the USA, India and China. On the other hand, Transport sales fell by 7% due to the downturn recorded in Spain (with a significant contribution from the T-Mobilitat interurban project in the same period of 2022) and AMEA, where a significant contribution was made by the Control and Ticketing Systems projects in Egypt in the first nine months of 2022.

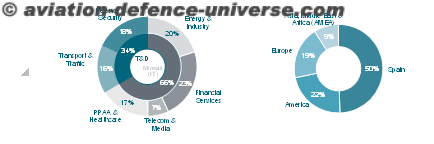

- The Minsait division’s revenues increased by 11% in local currency and all of its verticals posted increases. We should highlight the double-digit growth in Financial Services (15% in local currency), chiefly due to the inorganic contribution of the Chilean Nexus company specializing in payment systems as well as the excellent performance of the business in Mexico and Spain, and Energy & Industry (14% in local currency), with increases in all of the regions, especially in the Energy and Retail sectors. We must also mention the performance of Public Administrations & Healthcare (8% in local currency), with rises in all of the regions except AMEA (due to the impact of the Angola Elections project that was executed in the same period of the previous year). Without the Elections business, sales would have increased by 20% in reported terms. In turn, Telecom & Media revenues increased slightly (by 0.4% in local currency).

Revenues in the third quarter of 2023 increased by 16% in local currency (13% in reported terms):

- Revenues from the Transport & Defence division rose by 30% in local currency, driven by the increases totaling 39% in Defence & Security and 35% in Air Traffic. In addition, Transport grew by 6%.

- The revenues of the Minsait division rose by 10% in local currency, with all of the verticals displaying growth, except for Telecom & Media, which fell slightly (by 2% in local currency). The double-digit increases of Financial Services (14% in local currency) and Energy & Industry (11% in local currency) were considerable, as well as that of Public Administrations & Healthcare (9% in local currency), which offset the contribution of the Angola Elections project executed in the third quarter of 2022 (€46 M). Without the Elections business, the sales of Public Administrations & Healthcare would have increased by 25% in reported terms.

The exchange rate reduced the revenues in the first nine months of 2023 by €36 M, chiefly due to the currency depreciation in the Americas (Argentina and Colombia) and AMEA (mainly the Philippines, Australia, China and India). The exchange rate reduced the figure by €27 M during the quarter, mainly because of the depreciation of the Argentine peso.

Organic revenues in the first nine months of 2023 (excluding the inorganic contribution of acquisitions and the exchange rate effect) rose by 11%. By divisions, Transport & Defence recorded organic growth totaling 17%, while that of Minsait rose by 8%. Organic revenues in the third quarter of the year increased by 13%, with rises of 28% in Transport & Defence and 6% in Minsait.

The revenues by countries displayed double-digit growths in the Americas (31% in local currency, 22% of total sales), Europe (25% in local currency, 19% of total sales) and Spain (12%, 50% of total sales). In contrast, AMEA was the only region in which revenues declined (22% in local currency, 9% of total sales).

Backlog at all-time highs

The backlog once again posted record highs in September 2023, standing at €6,974 M and displaying a rise of 17% in reported terms compared to the same period in 2022. The backlog of the Transport & Defence division amounted to €4,785 M and increased by 16% with respect to the previous year, with Defence & Security accumulating a backlog of €3,045 M. Minsait’s backlog amounted to €2,189 M, up 18% in relation to the first nine months of 2022. The ratio between the backlog and sales in the last twelve months stood at 1.67x, above the figure of 1.61x in the same months of the previous year.

The net order intake rose by 12% in local currency (10% in reported terms):

- The Transport & Defence order intake from January to September increased by 7% in local currency, driven by the growth of Air Traffic (14% in local currency), thanks to the ATM projects in Honduras and Belgium, and the progress made by Defence & Security (7% in local currency), especially in Spain (for the remaining amount of Phase 1B of the FCAS project, the Eurofighter Falcon project and the Identification and Self-Protection Systems for the F-18s) and AMEA (Air Defence Systems in Rwanda).

- Minsait’s order intake in the same period increased by 15% in local currency, in an environment of continuing high customer demand, with all of the verticals posting double-digit growth (Energy & Industry 16%, Public Administrations & Healthcare 15%, Telecom & Media 15% and Financial Services 14%). The growth of Public Administrations & Healthcare was significant, as it offset the high order intake recorded during the first nine months of 2022 due to the Angola Elections project.

Other relevant variables

The EBITDA reported from January to September 2023 totaled €305 M, compared to the figure of €282 M in the same period of 2022, thus displaying 8% growth, equivalent to an EBITDA margin of 10.1% this year and one of 10.5% in the same period of 2022. With respect to the third quarter only, the EBITDA totaled €116 M compared to €108 M in 3Q22 (equivalent to a margin of 11.6% set against 12.2%).

The Operating Margin in the first nine months stood at €269 M compared to €243 M in the same period of 2022, constituting a return which remains practically unchanged with respect to the previous year: 8.9% in 9M23 and 9% in 9M22. With regard to the quarter, the Operating Margin stood at €102 M compared to €93 M for the same months in 2022 (equivalent to a margin of 10.2% versus 10.5%).

- The Operating Margin of the Transport & Defence division in the first nine months of 2023 stood at €131 M in comparison with €105 M in the same period of the previous year, a rise equivalent to a margin of 13.0% set against the previous figure of 12.2%. This improvement was due to the increased profitability of Defence & Security and Air Traffic. The Operating Margin in the third quarter totaled €55 M, compared to €40 M in the same period of the previous year, a margin of 15.9% set against 14.7%.

- The Operating Margin of the Minsait division from January to September 2023 totaled €138 M compared to €137 M in the same months of 2022, with a margin of 6.9% in this period and one of 7.5% in the same period of 2022. This lower profitability was mainly due to the contribution of the Angola Elections project undertaken last year. As for the quarter only, the Operating Margin stood at €47 M versus €53 M in the third quarter of 2022, equivalent to a margin of 7.2% versus 8.6%, similarly due to the contribution of the Angola Elections project undertaken during the period under analysis.

The EBIT reported in the period comprising the first three quarters of 2023 totaled €228 M in comparison with the same period of 2022 (€204 M), a figure up 12% in reported terms and equivalent to a margin of 7.6% in the two periods. However, with respect to the quarter, the reported EBIT stood at €89 M vs. €81 M, constituting an 8.9% EBIT margin vs. 9.1% in 3Q22:

- The EBIT Margin of Transport & Defence in the first nine months stood at 12.1%, set against the figure of 11.3% in 9M22. The EBIT Margin stood at 15.3% in the quarter, compared to 13.7% in 3Q22.

- Minsait’s EBIT margin totaled 5.3%, compared to the figure of 5.8% for the same phase of 2022. In terms solely of the quarter, it stood at5% compared to 7.1% in 3Q22.

The Net Profit amounted to €146 M from January to September 2023, up from €116 M in the same phase of 2022, reflecting a rise of 26%.

The Free Cash Flow in the first nine months totaled €117 M, compared to €54 M in the same period of 2022. The cash generation during the quarter totaled €63 M versus €30 M in 3Q22.

Finally, the Net Debt stood at €233 M in September 2023, in comparison with €220 M in September 2022 and €43 M in December 2022. The Net Debt/LTM EBITDA ratio (excluding the impact of IFRS 16 and the real estate plan provision) stood at 0.6x in September 2023, the same ratio as in September 2022 and with respect to the figure of 0.1x in December 2022. This increase in the Net Debt compared to December can chiefly be accounted for by the payments for purchased companies (including the €175 M for the purchase of a 9.5% stake in ITP Aero and €45 M for the acquisition of the Selex division of ATM in the USA), as well as the payment of the dividend in July (€44 M) charged against 2022 profits.

Goals for 2023

Revenues in local currency: higher than €4.150 M.

- Reported EBIT: higher than €325 M.

- Reported Free Cash Flow: higher than €210 M.

Key Highlights

In the 2022 fiscal year Indra purchased the Nexus and Mobbeel companies for the IT business and Simumak for the T&D business. So far in 2023 Indra has purchased the Deuser and ICASYS companies for the IT business and the Selex division of Air Traffic in the USA and Park Air for the T&D business. These acquisitions added €75 M to sales in 9M23 and only €3 M in 9M22.

Revenues by divisions and geographical areas