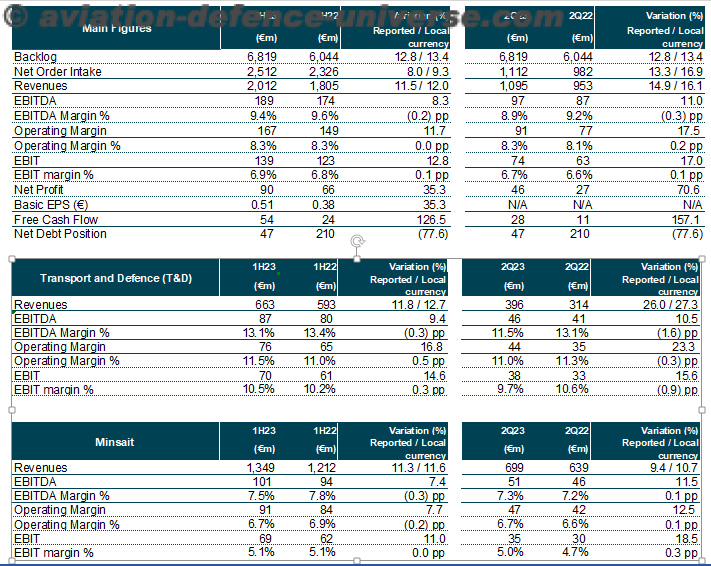

- 1H23 reported EBIT grew 12.8% vs 1H22, also accelerating its growth in the second quarter of 2023 to increase by 17.0% compared to last year same period

- Revenues up 11.5% in 1H23, accelerating to 14.9% in the second quarter of 2023 vs the same period of 2022: it stood out the strong growth showed in the quarter in Defence (up 48.7%) and Air Traffic (17.4%)

- Year-end targets are increased by 4% in revenues, EBIT and FCF

- 1H23 Free Cash Flow was €54m vs €24m in 1H22. As a result, Net Debt/EBITDA LTM ratio decreased to 0.1x compared to 0.6x in June 2022

- 1H23 Backlog reached all-time high, €6,819m, with Order Intake growing by 8% compared to 1H22, bolstered by Air Traffic, Transport and Minsait

- The Strategic Plan for the coming years, which will be presented in the first quarter of 2024, will be called LEAD G THE FUTURE

Madrid, Spain. 27 July 2023. According to Marc Murtra, Indra’s Chairman, “We continue on the path of changes, transformation and improvements at Indra. The arrival of José Vicente give us a new and important boost towards profitable growth, all with the ambition of making Indra the reference in the technology sectors in which it operates. This is a transformational, inspiring and exciting time for all of us at Indra. In this new stage we will concentrate all our efforts on continuing to grow in a profitable and sustainable manner and on reinforcing our technological leadership.”

Regarding the financial results, José Vicente de los Mozos, Indra’s Chief Executive Officer, said, “These very positive results are a reflection of the strength and commitment of all the teams that make up Indra. I would like to highlight in these data the commercial performance and its corresponding growth in order intake together with the acceleration in revenue growth and operating result. Furthermore, based on my vision of the strengths that I have seen during these first weeks in the company, I announce that we are going to improve our year-end outlook by 4 % in terms of revenues, EBIT and cash generation.”

On the other side, José Vicente de los Mozos, in reference to the Strategic Plan that will be presented in the first quarter 2024, added, “Based on these magnificent results, we will focus the entire company on the creation of a Strategic Plan for the years 2024-2026, but with a vision beyond 2030. This Strategic Plan will be born from within the company and will be based on growth through different vectors such as the optimization of the international footprint, the simplification and creation of the portfolio, and the commitment to value creation all across the activities in which Indra is present. In addition, we are the true leaders in ESG, a subject that is at the core of all our strategic decisions. We want Indra to be a benchmark company in all the areas in which it acts as a leader, which is why we have decided to name this plan LEAD G THE FUTURE.”

Main features

Indra’s revenues in the first half of 2023 rose by 12% in local currency (11% in reported terms) in comparison with the same period in 2022.

- Revenues from the Transport & Defence division grew by 13% in local currency, due to the sharp rise in Defence & Security (24% in local currency) and the contribution of the FCAS and Eurofighter projects, as well as Air Traffic (which showed an increase of 21% in local currency), with solid activity in all the geographical areas, especially Spain, Belgium, the United Kingdom, Panama, the USA and India. On the other hand, Transport sales fell by 12% due to the downturn recorded in Spain (the significant contribution of the T-Mobilitat interurban project in 1H22) and the Asia Pacific, Middle East and Africa (AMEA) region, where there was a significant impact caused by the Control and Ticketing Systems projects in Egypt and the Interurban System in Riyadh during the same period of the previous year.

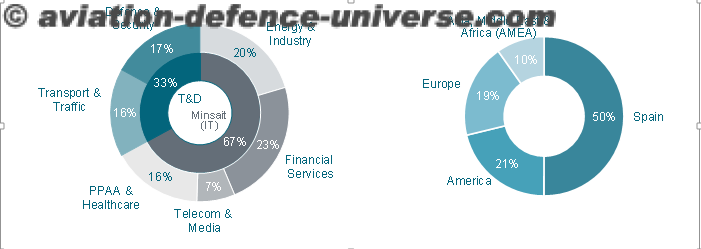

- Revenues from the Minsait division increased by 12% in local currency, with strong demand for its services and growth in all its verticals. In particular, we should mention the double-digit increases recorded in Energy & Industry (16% in local currency), in America (Energy in Brazil and Peru) and Spain (large customers in Energy, Retail and Food), as well as Financial Services (which grew by 15% in local currency), chiefly due to the inorganic contribution of the Chilean Nexus company, specializing in payment systems, and the excellent performance of the business in Mexico and Spain. The growth of Public Administrations & Health (7% in local currency) was also significant, thanks to the positive performance recorded in Spain, which offset the drop in AMEA due to the 2022 Angola Elections project. Telecom & Media grew slightly, by 1%.

Focusing specifically on the second quarter of 2023, revenues increased by 16% in local currency (15% in reported terms):

- Revenues from the Transport & Defence division rose by 27% in local currency, driven by the increases of 49% in Defence & Security and 22% in Air Traffic. Meanwhile, Transport fell by 3%.

- The revenues of the Minsait division rose by 11% in local currency, with all the verticals growing, except for Telecom & Media, which was down slightly (1% in local currency). The double-digit increases in Energy & Industry (17% in local currency) and Financial Services (16% in local currency) were significant.

Organic revenues in the first half of the year (excluding the inorganic contribution of acquisitions and the exchange rate effect) rose by 10%. By divisions, Transport & Defence recorded organic growth totaling 12%, while that of Minsait rose by 9%. Organic revenues in the second quarter increased by 14%, with rises of 26% in Transport & Defence and 8% in Minsait.

By geographical areas, we should highlight the double-digit rises recorded in sales in America, which went up from 339 million euros in the first half of 2022 to 425 million euros in the same period this year (an increase of 26% in local currency, accounting for 21% of total sales), in Europe, with an increase from 316 to 384 million euros (22% in local currency, equivalent to 19% of total sales), and Spain, which recorded 909 million euros in sales in the first six months of 2022 and 1,007 million euros in the same period this year (an 11% rise accounting for 50% of total sales). Conversely, AMEA was the only region that displayed downturns, falling from 240 to 196 million euros in the first six months of the year (a 17% decrease in local currency with a 10% share in total sales).

Record high for the backlog

- The backlog reached an all-time high in the first six months of 2023, standing at €6,819 M, a rise of 13% in reported terms compared to the same period of the previous year. The backlog of the Transport & Defence division totaled €4,769 M and increased by 17%, with Defence & Security accumulating a backlog of €3,075 M. Meanwhile, Minsait’s backlog totaled €2.051 M, up 4%.

- With respect to the last 12 months, the ratio between the backlog and sales stood at 1.68x in 1H23 vs. 1.69x in 1H22.

Net order intake during the first half of the year grew by 9% in local currency (8% in reported terms):

- Transport & Defence net order intake increased by 8% in local currency, driven by the sharp rise in Air Traffic (over 49% in local currency), and, in particular, by the ATM proposals in Belgium and Honduras and the increased activity with Enaire in Spain. Transport also grew by 20% in local currency, thanks to the Rail and Ticketing projects in Spain and the tunnel management in the United Kingdom. In contrast, Defence & Security net order intake fell (by 7% in local currency), due to the comparison with the previous year (when it rose by 64%), given that it was then driven by the contract for the modernization of the Tigre MKIII helicopters in Spain (c. €90 M).

- Minsait’s net order intake in 1H23 rose by 10% in local currency, with significant double-digit increases in Public Administrations & Health (an 18% rise in local currency), thanks to the positive activity in Spain, which also offset the high level of order intake recorded in the same period of 2022 due to the Elections project in Angola, as well as Energy & Industry (a 14% rise in local currency), with a particularly large degree of activity recorded in Spain, the Philippines, Italy and Peru. Financial Services also grew (an increase of 7% in local currency) due to America (specifically, Chile, Mexico and Peru). On the other hand, net order intake fell in Telecom & Media (8% in local currency) when compared with the significant activity recorded in 1H22 in America (the major contract in Colombia) and Spain (the renewal of major contracts with the main operator).

EBIT, Operating Margin and Net Profit

The EBIT reported in the first half of 2023 stood at 139 million euros, compared to €123 M in the same period in 2022. This represents an increase of 13% in reported terms, equivalent to a margin of 6.9% compared to the figure of 6.8% in 1H22. If only the second quarter of 2023 is taken into account, the reported EBIT stood at €74 M set against 63 million euros in the second quarter of 2022 (equivalent to an EBIT margin of 6.7% in 2Q23 vs. 6.6% in 2Q22):

- The EBIT Margin of Transport & Defence in the first six months of the year stood at 10.5%, set against the figure of 10.2% in the first half of 2022. The EBIT Margin in the second quarter of this year stood at 9.7% compared to the figure of 10.6% in the same quarter of the previous year, affected by the termination of the contract of the previous Chief Executive Officer (€4 M).

- Minsait’s EBIT Margin in 1H23 was 5.1%, the same profitability as that achieved by the unit in the first half of 2022. By quarters, the EBIT Margin stood at 5.0%, compared to 4.7% in 2Q22.

The reported EBITDA in 1H23 totaled €189 M vs. €174 M in 1H22, displaying growth of 8.3%, equivalent to an EBITDA margin of 9.4% in 1H23 and 9.6% in 1H22. Focusing solely on the second quarter of the year, the EBITDA totaled €97 M vs. €87 M in the same period of the previous year (equivalent to a margin of 8.9% this year, compared to 9.2% in 2022).

As for the Operating Margin, it stood at €167 M vs. €149 M in 1H22 (with the same 8.3% profitability in both periods). The Operating Margin in 2Q23 stood at €91 M vs. €77 M in the same quarter of the previous year (8.3% vs. 8.1%).

- The Operating Margin of Transport & Defence in 1H23 stood at €76 M vs. €65 M in 1H22, equivalent to a margin of 11.5% in 1H23 vs 11.0% in 1H22. This improvement was due to the increased profitability of Defence & Security and Air Traffic. The Operating Margin in 2Q23 was €44 M vs. €35 M in 2Q22, equivalent to a margin of 11.0% vs. 11.3% in 2Q22.

- Minsait’s Operating Margin in 1H23 totaled €91 M vs. €84 M in 1H22, equivalent to a margin of 6.7% vs 6.9%. This represents a slightly lower return, due to the lower contribution of the Elections project and the impact of wage inflation. The Operating Margin in 2Q23 was €47 M vs. €42 M in 2Q22, a margin of 6.7% vs. 6.6% in 2Q22, a figure increased by the operating leverage, the improved business mix and the lower pressure exerted by wage inflation.

The Net Profit totaled €90 M in the first six months of 2023, a figure well above the €66 M achieved during the same period of time in the previous year, representing growth of 35%.

Basic earnings per share (EPS) also increased, by 35.3% in comparison with 1H22.

The Free Cash Flow (FCF) in 1H23 stood at €54 M, in contrast to the figure of €24 M in 1H22. Cash generation in the second quarter totaled €28 M, compared to the figure of €11 M in the same period in 2022.

As a result, the Net Debt/LTM EBITDA ratio (excluding the IFRS 16 impact, the capital gain from the sale of the facilities and the provision for the real estate plan) stood at 0.1x in June 2023, far below the figure of 0.6x recorded in June 2022.

Lastly, the Net Debt of the Indra group stood at 47 million euros in June 2023 (an increase chiefly due to the payment for the acquisition of the Selex division of ATM in the US costing €45 M). It totaled €43 M in December 2022 and €210 M in June 2022.

New 2023 Targets

The company has updated its 2023 goals by revising them upwards:

- Revenues: over €4,150 M. (the previous forecast was over €4 billion)

- Reported EBIT: over €325 M (the previous forecast was above €315 M)

- Reported Free Cash Flow: over €210 M. (before, it was better than €200 M)

Indra has also announced that it will hold a Capital Market Day in the first quarter of 2024.

Key Highlights

- In 2022, Indra purchased the Nexus and Mobbeel companies for the IT business and Simumak for the T&D business, while, so far in 2023, it has purchased the Deuser company for the IT business and the Selex Air Traffic (ATM) division in the US for the T&D business. These acquisitions added €44.7 M to sales in 1H23 and only €0.3 M in 1H22.

Revenues by divisions and geographical areas