- A Year of Regulation and Reform: Inside MoCA’s 2025 Civil Aviation Strategy

- Year-End Review 2025: Indian Civil Aviation at a Crossroads

By Sangeeta Saxena

New Delhi. 30 December 2025. The year 2025 marked a defining phase for India’s Ministry of Civil Aviation (MoCA) as it navigated a complex operating environment shaped by rapid traffic growth, airline financial stress, infrastructure constraints, and rising passenger expectations. With aviation firmly positioned as a catalyst for economic growth and regional integration, MoCA’s policy interventions focused on maintaining sectoral stability while enabling long-term expansion. From rationalising cost structures and monitoring airfare dynamics to accelerating regional connectivity and strengthening regulatory oversight, the ministry’s actions reflected a measured, reform-oriented approach aimed at balancing commercial realities with public interest. And not to forget the 12th June Air India crash of Ahmedabad-London flight.

The year proved to be one of the most turbulent yet defining periods for Indian civil aviation. While the sector continued to demonstrate long-term growth potential driven by demand, infrastructure expansion, and policy reforms, it was equally marked by crises that exposed deep structural, operational, and governance challenges. From a tragic Air India crash to operational stress at IndiGo, alongside persistent supply-chain bottlenecks, regulatory pressures, and sustainability concerns, Indian aviation in 2025 reflected both promise and vulnerability.

One of the most sobering moments of the year was the Air India crash, which sent shockwaves across the aviation ecosystem. Beyond the tragic loss of lives, the incident reignited serious questions around aircraft maintenance oversight, safety audits, crew training standards, and accountability in the post-privatisation phase. While investigations remained ongoing, the crash underscored the risks associated with rapid fleet induction, legacy operational cultures, and the pressure to scale up aggressively in a highly competitive market. For policymakers and regulators, it became a reminder that growth without uncompromising safety governance can carry devastating consequences.

One of the most sobering moments of the year was the Air India crash, which sent shockwaves across the aviation ecosystem. Beyond the tragic loss of lives, the incident reignited serious questions around aircraft maintenance oversight, safety audits, crew training standards, and accountability in the post-privatisation phase. While investigations remained ongoing, the crash underscored the risks associated with rapid fleet induction, legacy operational cultures, and the pressure to scale up aggressively in a highly competitive market. For policymakers and regulators, it became a reminder that growth without uncompromising safety governance can carry devastating consequences.

Adding to the sector’s strain was the IndiGo crisis, which unfolded through a combination of aircraft groundings due to Pratt & Whitney engine issues, capacity shortfalls, rising lease costs and operational disruptions. Although IndiGo remained India’s largest airline by market share, its struggles highlighted the fragility of overdependence on a single aircraft family and a limited engine ecosystem. Flight cancellations, wet-lease dependencies, and schedule instability affected passenger confidence and strained airport operations nationwide. The crisis also exposed the broader vulnerability of Indian airlines to global supply-chain disruptions and OEM bottlenecks.

Beyond headline crises, Indian aviation grappled with persistent structural challenges throughout the year. Aircraft delivery delays, global shortages of engines and spare parts, and rising costs of maintenance, repair, and overhaul (MRO) services placed sustained financial pressure on carriers. High aviation turbine fuel (ATF) prices, despite some state-level tax rationalisation, continued to erode margins, especially for airlines operating on thin yields.

Infrastructure congestion at major hubs such as Delhi, Mumbai, and Bengaluru remained a concern despite ongoing expansion projects. Slot constraints, air traffic management complexities and ground handling bottlenecks impacted on-time performance. Meanwhile, regional connectivity routes under UDAN faced mixed outcomes, with some routes flourishing while others struggled due to weak demand and operational viability.

Infrastructure congestion at major hubs such as Delhi, Mumbai, and Bengaluru remained a concern despite ongoing expansion projects. Slot constraints, air traffic management complexities and ground handling bottlenecks impacted on-time performance. Meanwhile, regional connectivity routes under UDAN faced mixed outcomes, with some routes flourishing while others struggled due to weak demand and operational viability.

Regulatory oversight came under renewed scrutiny in 2025. Questions were raised about the adequacy of safety audits, enforcement mechanisms, and coordination between operators, OEMs, and regulators. At the same time, airlines faced acute workforce challenges. Pilot shortages, rising training costs and attrition in technical and ground handling roles strained operational resilience. Industrial relations issues and fatigue management also emerged as areas requiring urgent attention.

Sustainability pressures intensified as global aviation moved closer to carbon accountability. Indian airlines faced increasing expectations to align with international emissions frameworks, adopt sustainable aviation fuel (SAF) and invest in greener operations. However, high costs, limited SAF availability and lack of domestic incentives made large-scale adoption difficult, highlighting the gap between global climate ambitions and ground realities in emerging markets.

Despite these challenges, 2025 was not without significant positives. Passenger demand remained robust, driven by India’s growing middle class, domestic tourism and expanding regional connectivity. Airport infrastructure development continued at pace, with new terminals, regional airports and modernisation projects reinforcing India’s long-term aviation capacity.

The consolidation of Air India under the Tata Group, despite setbacks, also showed early signs of cultural and operational transformation, including improved customer experience initiatives and international network rationalisation. Cargo aviation remained resilient, supporting trade, e-commerce, and pharmaceutical supply chains amid global uncertainty.

The consolidation of Air India under the Tata Group, despite setbacks, also showed early signs of cultural and operational transformation, including improved customer experience initiatives and international network rationalisation. Cargo aviation remained resilient, supporting trade, e-commerce, and pharmaceutical supply chains amid global uncertainty.

Policy initiatives aimed at strengthening domestic MRO capabilities, aircraft leasing ecosystems and airspace modernisation signalled intent to reduce external dependencies over the long term. The growing emphasis on digitalisation, data-driven operations and passenger-centric services also reflected a sector adapting to changing expectations.

In retrospect, 2025 emerged as a year of reckoning for Indian civil aviation. The Air India crash and the IndiGo crisis served as stark reminders that rapid expansion must be matched by rigorous safety, resilience, and governance frameworks. At the same time, sustained demand growth, infrastructure investment, and policy reform reinforced the sector’s strategic importance to India’s economy.

As the industry moves into 2026, the key lesson is clear: India’s aviation ambitions can only be realised through balanced growth—where safety, operational robustness, workforce stability, and sustainability are treated as core pillars, not afterthoughts. The challenges of 2025 may ultimately prove constructive if they drive deeper reform, stronger oversight, and a more resilient aviation ecosystem for the decade ahead.

As of 2025, the status of work allocation to Indian Maintenance, Repair and Overhaul (MRO) organisations remained uneven and structurally constrained, despite strong policy intent and growing domestic capability. On the positive side, Indian MROs have seen incremental growth in line maintenance, component repair, engine shop visits (limited), airframe checks up to C-checks, and helicopter and regional aircraft maintenance. Airlines such as IndiGo, Air India Group, Akasa Air and Vistara (prior to merger) increased domestic line maintenance and light checks in India to reduce turnaround time and foreign exchange outflow. Defence offsets, UDAN-linked aircraft, business jets, helicopters, and military-civil crossover work also provided steady business for Indian MROs. Government initiatives—such as GST reduction on MRO services to 5%, customs duty rationalisation, and long-term land leases at airports—created a more enabling policy framework.

However, heavy maintenance and high-value engine and component work continued to be largely allocated to overseas MROs, particularly in Singapore, Malaysia, the Middle East, and Europe. The primary reasons included long-term airline contracts already locked with foreign OEM-approved MROs, OEM control over manuals, tooling, spares and certifications, limited engine MRO capacity in India for LEAP, PW1100G, Trent and other next-gen engines, airlines’ preference for proven turnaround times and global warranty linkages and financing and leasing conditions that often mandate OEM-approved overseas facilities.

However, heavy maintenance and high-value engine and component work continued to be largely allocated to overseas MROs, particularly in Singapore, Malaysia, the Middle East, and Europe. The primary reasons included long-term airline contracts already locked with foreign OEM-approved MROs, OEM control over manuals, tooling, spares and certifications, limited engine MRO capacity in India for LEAP, PW1100G, Trent and other next-gen engines, airlines’ preference for proven turnaround times and global warranty linkages and financing and leasing conditions that often mandate OEM-approved overseas facilities.

The entry of foreign OEM-backed MROs in India (Safran, Airbus, Boeing, Thales, Collins, Pratt & Whitney partners) further complicated allocation. While these facilities brought technology and credibility, much of the high-value work remained captive within OEM ecosystems, limiting subcontracting opportunities for independent Indian MROs. As a result, Indian players often operated at the lower end of the value chain, handling labour-intensive but lower-margin tasks.

Work allocation to Indian MROs in 2025 improved in volume but not proportionately in value. Capacity, skills and policy support existed, but OEM dominance, airline risk aversion, and leasing constraints continued to restrict the flow of core maintenance work. The sector’s next inflection point will depend on engine MRO indigenisation, enforceable “local work share” norms, stronger airline–MRO alignment and a shift from policy enablement to mandatory execution.

It will not be critical but truthful to state that Indian Maintenance, Repair and Overhaul (MRO) providers are facing a period of intense pressure as global OEMs such as Safran, Airbus, Thales, Boeing and other foreign majors have established their own MRO facilities in India, reshaping the competitive landscape. While the entry of OEM-led MROs strengthens India’s aviation ecosystem and reduces dependence on overseas maintenance, it also creates significant challenges for domestic players who operate with thinner margins and limited access to proprietary data, tooling and certification privileges. OEM-backed facilities enjoy natural advantages through guaranteed business from their aircraft and engine customers, preferential access to spares, faster regulatory approvals, and the ability to bundle maintenance with aircraft sales and long-term service agreements. In contrast, Indian MROs often struggle with high capital costs, delayed clearances, uneven tax regimes across states, and restricted access to technical documentation and software controlled by OEMs. The risk is that local MROs may be relegated to lower-value work while high-value engine and component maintenance remains dominated by foreign players. For India’s MRO ambitions to mature sustainably, policy support, fair access to data and spares, skill development and collaborative models between OEMs and Indian firms will be essential to ensure that domestic players grow alongside global entrants rather than being crowded out.

A peep into activities of the aircraft leasing industry in India in the year showed clear signs of maturation but remained a work in progress, positioned between strong policy intent and slow-ground execution. India’s leasing ecosystem, anchored primarily in GIFT City (IFSC), Gujarat, continued to gain credibility as a domestic alternative to traditional offshore hubs such as Dublin, Singapore and Hong Kong. Several Indian and foreign lessors registered entities in GIFT City, encouraged by tax incentives, regulatory clarity under the IFSCA and government push to onshore aircraft financing and leasing. By 2025, a growing number of sale-and-leaseback transactions, engine leasing arrangements and helicopter leasing deals were structured through IFSC entities, reflecting early but tangible progress. However, scale remained the biggest challenge. While registrations increased, the volume of aircraft actually leased from India was still modest compared to global leasing hubs. Indian airlines continued to rely heavily on established foreign lessors due to deeper capital pools, faster deal execution and greater market confidence. Issues such as withholding tax clarity, repossession enforceability, Cape Town Convention implementation consistency and bankruptcy resolution timelines continued to concern global financiers, despite improvements. The leasing industry in 2025 also expanded beyond commercial aircraft to include engines, APUs, helicopters and business jets, aligning with India’s diverse aviation growth. Lessors increasingly explored partnerships with Indian airlines, MROs and insurers, signalling an ecosystem approach rather than standalone leasing entities. 2025 marked a transition phase for India’s leasing industry—from policy-driven ambition to early operational reality. While India had not yet emerged as a global leasing powerhouse, it successfully laid the regulatory and institutional groundwork. The direction was clearly positive, but confidence, deal flow, and global acceptance remained the decisive factors that would determine whether India could truly anchor a competitive leasing hub in the years ahead.

A peep into activities of the aircraft leasing industry in India in the year showed clear signs of maturation but remained a work in progress, positioned between strong policy intent and slow-ground execution. India’s leasing ecosystem, anchored primarily in GIFT City (IFSC), Gujarat, continued to gain credibility as a domestic alternative to traditional offshore hubs such as Dublin, Singapore and Hong Kong. Several Indian and foreign lessors registered entities in GIFT City, encouraged by tax incentives, regulatory clarity under the IFSCA and government push to onshore aircraft financing and leasing. By 2025, a growing number of sale-and-leaseback transactions, engine leasing arrangements and helicopter leasing deals were structured through IFSC entities, reflecting early but tangible progress. However, scale remained the biggest challenge. While registrations increased, the volume of aircraft actually leased from India was still modest compared to global leasing hubs. Indian airlines continued to rely heavily on established foreign lessors due to deeper capital pools, faster deal execution and greater market confidence. Issues such as withholding tax clarity, repossession enforceability, Cape Town Convention implementation consistency and bankruptcy resolution timelines continued to concern global financiers, despite improvements. The leasing industry in 2025 also expanded beyond commercial aircraft to include engines, APUs, helicopters and business jets, aligning with India’s diverse aviation growth. Lessors increasingly explored partnerships with Indian airlines, MROs and insurers, signalling an ecosystem approach rather than standalone leasing entities. 2025 marked a transition phase for India’s leasing industry—from policy-driven ambition to early operational reality. While India had not yet emerged as a global leasing powerhouse, it successfully laid the regulatory and institutional groundwork. The direction was clearly positive, but confidence, deal flow, and global acceptance remained the decisive factors that would determine whether India could truly anchor a competitive leasing hub in the years ahead.

2025 saw helicopter tourism in India continuing its gradual but steady expansion, driven largely by religious and regional connectivity needs rather than pure leisure travel. Pilgrimage circuits such as Kedarnath–Badrinath, Vaishno Devi, Amarnath, Ayodhya, Tirupati and Shirdi remained the primary demand drivers, ensuring high utilisation during peak seasons and making heli services commercially viable despite high operating costs. State governments and shrine boards increasingly viewed helicopters as essential infrastructure for crowd management, disaster response and medical evacuation, leading to improved helipad networks, better air traffic coordination and stricter safety oversight. However, heli tourism still faced challenges including weather-related disruptions, limited pilot availability, rising insurance premiums and regulatory compliance costs. While scenic and luxury heli tourism showed marginal growth in select regions, the sector in 2025 was defined more by utility, access and safety than by high-end tourism, firmly positioning helicopters as a mobility solution rather than a luxury indulgence. In conclusion, religious tourism is the single most important driver sustaining helicopter tourism in India today. It has moved heli services from an elite offering to a functional mass-utility service in specific regions, anchoring demand, justifying investment, and shaping policy focus. If safety frameworks, cost structures, and infrastructure continue to improve, religious-led heli tourism could serve as the launchpad for a broader, more inclusive helicopter aviation market in India.

2025 saw helicopter tourism in India continuing its gradual but steady expansion, driven largely by religious and regional connectivity needs rather than pure leisure travel. Pilgrimage circuits such as Kedarnath–Badrinath, Vaishno Devi, Amarnath, Ayodhya, Tirupati and Shirdi remained the primary demand drivers, ensuring high utilisation during peak seasons and making heli services commercially viable despite high operating costs. State governments and shrine boards increasingly viewed helicopters as essential infrastructure for crowd management, disaster response and medical evacuation, leading to improved helipad networks, better air traffic coordination and stricter safety oversight. However, heli tourism still faced challenges including weather-related disruptions, limited pilot availability, rising insurance premiums and regulatory compliance costs. While scenic and luxury heli tourism showed marginal growth in select regions, the sector in 2025 was defined more by utility, access and safety than by high-end tourism, firmly positioning helicopters as a mobility solution rather than a luxury indulgence. In conclusion, religious tourism is the single most important driver sustaining helicopter tourism in India today. It has moved heli services from an elite offering to a functional mass-utility service in specific regions, anchoring demand, justifying investment, and shaping policy focus. If safety frameworks, cost structures, and infrastructure continue to improve, religious-led heli tourism could serve as the launchpad for a broader, more inclusive helicopter aviation market in India.

General Aviation in India in 2025 presented a mixed picture of opportunity and constraint. On the positive side, growing demand from business travel, emergency medical services, charter operations and pilot training sustained the sector, while improved airport infrastructure under UDAN and regional connectivity initiatives indirectly benefited GA operations. Corporate aviation and non-scheduled operators continued to support time-critical travel for industry and government, though growth remained uneven. At the same time, GA faced persistent structural challenges including high taxation on fuel, limited MRO access, complex regulatory processes, restricted airport slots at metro airports and rising operational costs. Entry of global OEMs and MROs improved technical capability but intensified competition for Indian players. In 2025, General Aviation was no longer purely a “rich man’s domain,” yet affordability and accessibility remained key hurdles. The sector stood at an inflection point—rich in potential but still awaiting policy simplification, cost rationalisation, and ecosystem-level reforms to unlock sustained growth.

General aviation in India remains a sector of significant untapped potential, marked by a mix of gradual progress and persistent constraints. On the positive side, rising demand for business aviation, charter services, air ambulances and helicopter operations for offshore energy, disaster response and regional connectivity has kept the segment relevant, while government initiatives such as UDAN have improved awareness of non-scheduled aviation and helicopter connectivity to remote regions. India’s growing economy, expanding corporate base and increasing need for time-efficient travel have also strengthened the case for business jets and turboprops. However, the sector continues to face serious challenges, including high acquisition and operating costs, heavy taxation on fuel, complex regulatory processes, limited dedicated general aviation infrastructure at airports, and a shortage of trained pilots and engineers. Access to hangar space, parking and maintenance remains difficult at major airports, where GA often receives lower priority compared to scheduled airlines. Additionally, inconsistent state-level policies and a lack of long-term clarity on incentives have slowed investment. As a result, while general aviation in India is slowly evolving and demonstrating its strategic and economic value, its growth remains constrained by structural, regulatory and cost-related hurdles that need coordinated policy attention to unlock the sector’s full potential. And general aviation in India is still largely perceived—and in many cases functions—as a rich man’s option.

General aviation in India remains a sector of significant untapped potential, marked by a mix of gradual progress and persistent constraints. On the positive side, rising demand for business aviation, charter services, air ambulances and helicopter operations for offshore energy, disaster response and regional connectivity has kept the segment relevant, while government initiatives such as UDAN have improved awareness of non-scheduled aviation and helicopter connectivity to remote regions. India’s growing economy, expanding corporate base and increasing need for time-efficient travel have also strengthened the case for business jets and turboprops. However, the sector continues to face serious challenges, including high acquisition and operating costs, heavy taxation on fuel, complex regulatory processes, limited dedicated general aviation infrastructure at airports, and a shortage of trained pilots and engineers. Access to hangar space, parking and maintenance remains difficult at major airports, where GA often receives lower priority compared to scheduled airlines. Additionally, inconsistent state-level policies and a lack of long-term clarity on incentives have slowed investment. As a result, while general aviation in India is slowly evolving and demonstrating its strategic and economic value, its growth remains constrained by structural, regulatory and cost-related hurdles that need coordinated policy attention to unlock the sector’s full potential. And general aviation in India is still largely perceived—and in many cases functions—as a rich man’s option.

In 2025, the Indian aviation cargo industry emerged as one of the most resilient and strategically significant segments of the country’s civil aviation ecosystem, even as passenger aviation grappled with volatility, cost pressures, and operational disruptions. Air cargo not only sustained momentum but also expanded its role as a critical enabler of trade, manufacturing, healthcare, and global supply chains. The industry benefited from India’s growing export base in pharmaceuticals, electronics, perishables, engineering goods, and high-value manufacturing, alongside sustained demand from e-commerce and express logistics. Pharma cargo, in particular, remained a cornerstone, with India reinforcing its position as a global supplier of generic medicines and vaccines, driving demand for temperature-controlled air cargo solutions. Semiconductor-related movements, aerospace components, and defence-linked shipments also contributed to specialised cargo growth.

Structurally, 2025 saw continued investment in infrastructure, including modern cargo terminals, freighter-friendly airports, and off-airport facilities such as Air Freight Stations (AFS). The commissioning of India’s first RA-3–accredited Greenfield AFS marked a milestone, reflecting a shift toward integrated, secure, and efficient cargo handling ecosystems. Government initiatives under PM Gati Shakti, the National Logistics Policy, and multimodal connectivity programs improved cargo evacuation, reduced dwell time, and strengthened hinterland linkages. On the airline side, Indian and foreign carriers expanded freighter operations and belly cargo capacity, with new routes connecting India to Europe, the Middle East, Africa, and East Asia. Airlines, GSAs, and cargo operators increasingly relied on data-driven demand forecasting, digital booking platforms, and dynamic pricing to manage yields amid fluctuating global trade patterns. However, high fuel costs, volatile freight rates, geopolitical disruptions, and capacity imbalances continued to pressure margins.

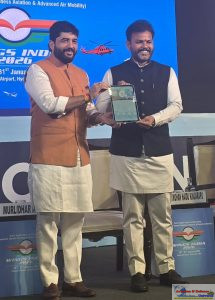

The Indian Ministry of Civil Aviation in recent years benefited from the energy and outlook of two relatively young ministers whose leadership style brought a refreshing shift in tone and approach. Their tenure was marked by an open, consultative attitude toward industry stakeholders, startups, airlines, airports, MROs and state governments, reflecting a willingness to listen and adapt rather than rely solely on legacy policy thinking. Both ministers demonstrated a strong grasp of the sector’s structural challenges—from airport capacity constraints and financial stress in airlines to regional connectivity, safety oversight, and skill shortages—and showed readiness to engage with criticism rather than deflect it. Their positive attitude was evident in sustained engagement with industry bodies, crisis communication during disruptions and an emphasis on long-term institution building over short-term optics. Equally important was their ability to face challenges head-on, whether navigating post-pandemic recovery, managing public scrutiny during accidents and operational crises or balancing rapid growth with safety and regulatory discipline. This combination of youth, confidence, accessibility and problem-solving orientation helped inject momentum into civil aviation governance and reinforced the perception of the ministry as proactive, responsive and aligned with the evolving needs of one of India’s most complex and fast-growing sectors.

The Indian Ministry of Civil Aviation in recent years benefited from the energy and outlook of two relatively young ministers whose leadership style brought a refreshing shift in tone and approach. Their tenure was marked by an open, consultative attitude toward industry stakeholders, startups, airlines, airports, MROs and state governments, reflecting a willingness to listen and adapt rather than rely solely on legacy policy thinking. Both ministers demonstrated a strong grasp of the sector’s structural challenges—from airport capacity constraints and financial stress in airlines to regional connectivity, safety oversight, and skill shortages—and showed readiness to engage with criticism rather than deflect it. Their positive attitude was evident in sustained engagement with industry bodies, crisis communication during disruptions and an emphasis on long-term institution building over short-term optics. Equally important was their ability to face challenges head-on, whether navigating post-pandemic recovery, managing public scrutiny during accidents and operational crises or balancing rapid growth with safety and regulatory discipline. This combination of youth, confidence, accessibility and problem-solving orientation helped inject momentum into civil aviation governance and reinforced the perception of the ministry as proactive, responsive and aligned with the evolving needs of one of India’s most complex and fast-growing sectors.

In 2025, the Indian Ministry of Civil Aviation (MoCA) took a series of pragmatic decisions aimed at stabilising the aviation ecosystem while sustaining growth and regional connectivity. One of the key focus areas was the GST regime, where the ministry continued engagement with the Ministry of Finance to rationalise taxes impacting airlines, MROs and leasing, particularly pushing for relief on aviation turbine fuel (ATF) and maintenance inputs to reduce cost pressures on carriers. While a full inclusion of ATF under GST remained unresolved, MoCA’s sustained advocacy helped keep the issue central to policy discourse. The ministry also maintained close oversight on airlines’ fare practices, especially during peak travel seasons and disruptions, urging carriers to maintain a balance between commercial viability and passenger affordability. Through data-driven monitoring and regular consultations, MoCA sought to curb predatory pricing as well as excessive fare spikes, reinforcing the need for responsible market behaviour in a rapidly expanding aviation market. And the most important outcome of the vibrant Ministers’ team were the Regional Civil Aviation Meets held all through the country, lead by them personally in collaboration with FICCI. Not to forget another feather in the MOCA’s cap-India hoted the IATA AGM 2025 at Bharat Mandapam in Delhi.

Another significant thrust in 2025 was the operationalisation of non-operational and underutilised airfields under the UDAN scheme, strengthening regional air connectivity. MoCA worked with state governments, the Airports Authority of India and the Indian Air Force for dual use of the airforce bases, revive dormant airstrips, improve basic infrastructure and make them viable for civilian operations. This effort aligned with broader goals of economic inclusion, tourism growth and last-mile connectivity, particularly in underserved and aspirational districts. Beyond UDAN, the ministry also pushed reforms in areas such as airport privatisation and capacity expansion, strengthening safety oversight through DGCA, promoting domestic MRO capabilities and supporting sustainable aviation initiatives including SAF discussions and green airport practices. Collectively, MoCA’s 2025 decisions reflected a balancing act between regulation and facilitation—seeking to ensure orderly growth, financial discipline, regional inclusion, and long-term resilience of India’s civil aviation sector. And the year ended with the high profile opening of the Navi Mumbai Airport with the landing of Indigo’s Bengaluru flight on Christmas Day.

Another significant thrust in 2025 was the operationalisation of non-operational and underutilised airfields under the UDAN scheme, strengthening regional air connectivity. MoCA worked with state governments, the Airports Authority of India and the Indian Air Force for dual use of the airforce bases, revive dormant airstrips, improve basic infrastructure and make them viable for civilian operations. This effort aligned with broader goals of economic inclusion, tourism growth and last-mile connectivity, particularly in underserved and aspirational districts. Beyond UDAN, the ministry also pushed reforms in areas such as airport privatisation and capacity expansion, strengthening safety oversight through DGCA, promoting domestic MRO capabilities and supporting sustainable aviation initiatives including SAF discussions and green airport practices. Collectively, MoCA’s 2025 decisions reflected a balancing act between regulation and facilitation—seeking to ensure orderly growth, financial discipline, regional inclusion, and long-term resilience of India’s civil aviation sector. And the year ended with the high profile opening of the Navi Mumbai Airport with the landing of Indigo’s Bengaluru flight on Christmas Day.

Despite deep dives and roller-coaster rides, as India’s aviation ecosystem continues to evolve, MoCA’s year-end performance in 2025 reiterated its role as both a regulator and facilitator. By keeping sustained pressure on GST reforms, closely monitoring airline pricing practices, reviving non-operational airfields under UDAN, and pushing infrastructure and safety reforms, the ministry demonstrated a commitment to inclusive and resilient growth. While structural challenges remain, particularly in taxation, capacity and sustainability, MoCA’s steady leadership and policy continuity have laid a stronger foundation for the sector. The year closed with cautious optimism—recognising that the path ahead demands consistency, collaboration and adaptability to ensure Indian civil aviation remains accessible, competitive and future-ready.