- Order intake: €10.4 billion, down -4% (-4% on an organic basis1)

- Sales: €10.3 billion, up 8.1% (+8.1% on an organic basis)

- Adjusted EBIT2: €1,248 million, up 13.9% (+12.7% on an organic basis)

- Adjusted net income, Group share2: €877 million, up 1% and including €60 million of exceptional contribution to corporate tax in France

- Net income from continuing operations, Group share: €664 million, up 6%

- Free operating cash flow2: €499 million, to be compared to -€85 million in the first half of 2024

2025 targets3, including upgraded sales guidance:

- Book-to-bill ratio4 above 1

- Organic sales growth between +6% and +7%5 (vs. +5 and +6% previously)

- Adjusted EBIT margin: 12.2% to 12.4%

Thales’ Board of Directors (Euronext Paris: HO) met on July 22, 2025 to review the financial statements for the first half of 20256.

Thales’ Board of Directors (Euronext Paris: HO) met on July 22, 2025 to review the financial statements for the first half of 20256.

“The first half of 2025 confirms Thales’ strong momentum since the beginning of the year, with a significant increase in our financial indicators.

Sales are up sharply, driven by the strength of our Defence and Avionics businesses, which are benefiting from continued increases in production capacity. This sustained performance enables us to raise our annual target for sales organic growth. Order intake continues to record solid momentum, in a favorable context for the vast majority of our businesses. They will once again exceed sales in 2025, offering exceptional visibility for the coming years. Adjusted EBIT margin has also improved significantly, demonstrating the relevance of the Group’s strategy based on disruptive innovation, operational excellence and a relationship of trust with our customers.

We are also continuing to invest in research and in expanding our industrial capacities, in order to meet the major challenges of a rapidly changing world.

This solid first half is above all the result of the commitment and professionalism of Thales’s 83,000 employees, to whom I extend my warmest thanks. Thanks to them, we are entering the second half of the year with an upwardly revised sales growth target,” said Patrice Caine, Chairman & Chief Executive Officer

Key figures

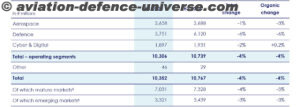

Order intake in the first half of 2025 amounted to €10,352 million, down -4% compared with the first half of 2024 (-4% also at constant scope and exchange rates). This slight decrease is explained by a high comparison basis, with the signing of three contracts with a unit value of more than €500 million in the first half of 2024 compared to only one in the first half of 2025. The sales momentum remains nonetheless very positive and the consolidated order book at June 30, 2025, totaled €50 billion, showing an increase of 7% compared to the first half of 2024. In this regard, the Group expects in the second half of this year the booking of the Air Defence contract signed with the United Kingdom for an amount of £1.16 billion, effective in July 2025.

Sales totaled €10,265 million, up 8.1% in total change and at constant scope and exchange rates compared with the first half of 2024. The increase in sales benefited notably from a solid performance of Avionics and Defence.

The Group reports for the first half of 2025 an Adjusted EBIT of €1,248 million, compared with €1,096 million in the first half of 2024, up 13.9% (+12.7% on an organic basis). The Adjusted EBIT margin reached 12.2% of sales, a significant increase compared to the first half of 2024 (11.5% of sales).

At €877 million, the Adjusted net income, Group share is up by 1% compared to last year. It incorporates a temporary additional contribution to the corporate tax in France amounting to €60 million. Excluding this exceptional impact, the Adjusted net income, Group share is up by 8%.

Net income from continuing operations, Group share amounted to €664 million compared to €625 million in the first half of 2024.

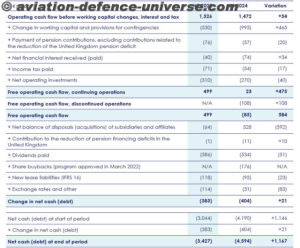

Free operating cash flow was positive and amounted to €499 million, compared with -€85 million in the first half of 2024. This strong increase was driven by a significant improvement in the change in working capital requirement compared to June 30, 2024, thanks notably to a continued satisfactory payment profile from Group’s customers as well as ongoing actions taken in the context of stocks optimization.

Net debt reached €3427 million at June 30, 2025 compared to €3 044 million at December 31, 2024.

Order intake

Order intake

Order intake in H1 2025 amounted to €10,352 million, down -4% compared to H1 2024 (-4% also at constant scope and exchange rates). The Group continued to benefit from excellent sales momentum across all its activities and recorded a contract with unit value in excess of €1 billion in the second quarter related to the supply of 26 Rafale Marine to India. The book-to-bill ratio is 1.01 (1.13 in the first half of 2024).

Thales booked 10 large orders with a unit amount exceeding €100 million in the first half of 2025, for a total amount of €2,874 million:

5 large orders booked in Q1 2025:

- Contract signed with Space Norway, a Norwegian satellite operator, for the supply of the THOR 8 telecommunications satellite;

- Order by SKY Perfect JSAT to Thales Alenia Space of JSAT-32, a geostationary telecommunications satellite;

- Signing of a contract between Thales and the European Space Agency (ESA) to develop Argonaut, a future autonomous and versatile lunar lander designed to deliver cargo and scientific instruments to the Moon;

- Order from the Dutch Ministry of Defence for the modernization and support of vehicle tactical simulators;

- Order from the French Defence Procurement Agency (DGA) for the development, production, and maintenance of vetronics equipment for various Army vehicles as part of the SCORPION programme.

5 large orders booked in Q2 2025:

- Contract related to the supply of 26 Rafale Marine to India to equip the Indian Navy;

- As part of the SDMM (Strategic Domestic Munition Manufacturing) contract signed in 2020 for the supply of ammunition to the Australian armed forces, entry into force of years 6 to 8. The continuation of the SDMM contract concerns the design, the development, manufacture and maintenance of a variety of ammunition;

- Contract for the delivery to Ukraine of 70 mm ammunition and the transfer of the final assembly line of certain components of this ammunition from Belgium to Ukraine;

- Order for the production and supply of AWWS (Above-Water Warfare System) combat systems intended for frigates equipment in Europe;

- Order by Sweden of compact multi-mission medium range Ground Master 200 radars.

At €7,479 million, order intake of a unit amount below €100 million showed an increase of 4% compared to the first half of 2024. Orders with a unit value of less than €10 million are up 5%.

Geographically9, order intake in mature markets amounted to €7,031 million, down compared to the first half of 2024 (-4% in total change and -5% on an organic basis). This decline is mainly explained by a high comparison base in the first half of 2024, which included the contract related to the order of two F126 frigates by the German Navy.

Order intake in emerging markets amounted to €3,321 million, down -3% in total and organic change. The registration of the order by the Indian Navy for 26 Rafale Marine in the first half of 2025 does not fully compensate the two contracts with a unit value exceeding €500 million recorded in the first half of 2024 in those markets.

Order intake in the Aerospace segment stood at €2,658 million compared to €2,688 million in the first half of 2024 (-3% at constant scope and exchange rates). The Avionics market enjoys sustained sales momentum in its various segments. Order intake in the Space activity, which had benefited from a favorable phasing in the first quarter with 3 orders worth more than €100 million each, was slightly down over the semester.

With an amount of €5,751 million (compared to €6,120 million in the first half of 2024, i.e., -6% at constant scope and exchange rates), order intake in the Defence segment continued to benefit from strong commercial momentum, while the basis for comparison with 2024 is high. Six orders with a unit amount exceeding €100 million were booked in the first half of 2025, including an order exceeding €1 billion from India for 26 Rafale Marine. The Group confirms its objective of a book-to-bill ratio above 1 in 2025 for the Defence segment, notably with the expected booking of new important contracts in the second half of the year, including the Air Defence contract with the United Kingdom for an amount of £1.16 billion, effective in July 2025. The order book stood at €38.9 billion (compared to €36.5 billion in the first half of 2024), representing approximately 3.4 years of sales.

At €1,897 million, order intake in the Cyber & Digital sector is aligned with sales, as most of the activities in this segment operate on short cycles. The order book is therefore not significant.

Sales

Sales

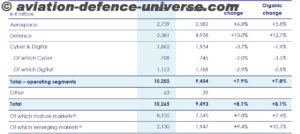

Sales for the first half of 2025 stood at €10,265 million, compared to €9,493 million in the first half of 2024, up 8.1% both in total and organic changes.

From a geographical standpoint10, sales recorded solid growth in emerging markets, with organic growth of +10.7%. Sales in mature markets grew organically by +7.4%, driven notably by Europe (+8.9%).

In the Aerospace segment, sales amounted to €2,759 million, up 6.8% compared with the first half of 2024 (+5.8% at constant scope and exchange rates). This solid growth reflects the continued strong momentum in the Avionics market, driven by aftermarket activities and the military domain. Space sales remained affected by last two years’ low demand in telecommunications satellites; OEN (Observation, Exploration, Navigation) showed good performance.

Sales in the Defence segment totaled €5,581 million, up 13.0% compared to the first half of 2024 (+12.7% at constant scope and exchange rates). After a very strong first quarter (+15.0% at constant scope and exchange rates), the segment continued to record double-digit growth in the majority of its activities in the second quarter.

At €1,862 million, sales in the Cyber & Digital segment decreased by -3.7% compared to the first half of 2024 (-1.9% at constant scope and exchange rates). This evolution reflects the following trends:

- Cyber businesses recorded a decrease in the first half of 2025 (-3.5% at constant scope and exchange rates):

- The Cyber Products business, slightly down in the second quarter after a first quarter of growth, remained affected as expected by disturbances related to the merger of Thales and Imperva’s sales forces. This now completed merger is the final step of Imperva’s integration and paves the way to the deployment of its product offering to its full potential. A progressive ramp-up in sales trajectory is expected in the second half of the year;

- The Cyber Services business was affected by soft market demand during the first half of the year. With this offer, which represents approximately 20% of the Cyber activity (as per 2024 sales), the Group continues to refocus its strategy on segments offering profitable growth. This process, which involves streamlining and standardizing operations, aims at improving operating margin and can occasionally weigh on volumes.

Digital businesses were stable in the first half of 2025 (-0.8% at constant scope and exchange rates):

- Identity and Biometrics solutions were down over half-year. The activity, which had experienced a decline in sales in 2020 due to COVID, is affected in 2025 by an unfavorable comparison effect related to the significant catch-up that occurred post-pandemic and until 2024. The segment thus returns to a more usual run rate in 2025;

- Secure Connectivity solutions experienced robust and profitable growth, driven by digital solutions (including eSIMs as well as on-demand connectivity platforms);

- Within the Payment Services business, digital banking solutions stood out particularly this semester and recorded a solid performance.

Results

The Group posted an Adjusted EBIT11 of €1,248 million for the first half of 2025, at 12.2% of sales, compared to €1,096 million (11.5% of sales) in the first half of 2024.

The Aerospace segment recorded an Adjusted EBIT of €252 million (9.1% of sales), compared with €167 million (6.5% of sales) in the first half of 2024. The Adjusted EBIT margin recorded a strong increase, driven by the solid performance of the Avionics activities that posted a robust double-digit margin. It also benefited from the significant Adjusted EBIT improvement in Space, which is expected to be positive in 2025 before restructuring costs.

Adjusted EBIT for the Defence segment amounted to €720 million, compared with €639 million in the first half of 2024 (+13.5% at constant scope and exchange rates). At 12.9%, the margin in this sector is stable compared to last year (12.9% in the first half of 2024).

The Cyber & Digital segment recorded an Adjusted EBIT of €265 million in the first half of 2025 compared to €272 million in the first half of 2024. The margin was up slightly and amounted to 14.2% of sales (against 14.1% in the first half of 2024). This evolution reflects the Group’s ability to preserve its commercial margins thanks to a strict discipline in terms of pricing policy.

Excluding Naval Group, unallocated EBIT amounted to -€24 million compared to -€26 million in the first half of 2024.

At €35 million in the first half of 2025, Naval Group’s contribution to Adjusted EBIT is lower compared to the first half of 2024. This change is mainly explained by the temporary additional contribution to corporate tax in France, whose impact on Naval Group’s share amounts to €5 million this semester and is expected to reach €8 million for the full year.

Cost of net financial debt amounts to -€56 million compared to -€87 million in the first half of 2024. This improvement is mainly explained by a significantly lower net debt than at June 30, 2024. Other adjusted financial income11 amounted to -€30 million over the first 6 months of 2025, compared with €32 million in the first half of 2024. This evolution reflects the non-recurrence in the first half of 2025 of exceptional items recorded during the first half of 2024, notably the distribution of dividends from non-consolidated affiliates as well as foreign exchange gains. The adjusted financial expense on pensions and other long-term employee benefits12 was stable at -€26 million compared to -€28 million in the first half of 2024.

Adjusted net income, Group Share12 thus amounted to €877 million, compared with €866 million in the first half of 2024, after an adjusted income tax charge12 of -€277 million compared with -€193 million in the first half of 2024. This change is mainly explained by the recording in the first half of 2025 of the additional temporary contribution to corporate tax in France, which reduced Adjusted net income by €60 million. The effective tax rate as of June 30, 2025 stood at 26.7% and at 21.0% excluding the additional contribution to corporate tax in France (compared to 20.4% as of June 30, 2024).

Adjusted net income, Group share, per share12 amounted to €4.27, up 1% compared with the first half of 2024 (€4.21).

Net income from continuing operations, Group share amounted to €664 million, an increase of 6% compared to June 30, 2024 (€625 million).

Financial position as of June 30, 2025

Financial position as of June 30, 2025

Free operating cash flow was positive at €499 million, compared to -€85 million in the first half of 2024. This strong increase was mainly driven by the improvement in the change in working capital requirements.

Over 2025 half-year, the net balance of acquisitions and disposals of subsidiaries and affiliates of -€64 million mainly consisted of the final price adjustment related to the sale to Hitachi Rail of the Transport activity on May 31, 2024. The Group did not finalize any significant acquisition or disposal over the period.

As of June 30, 2025, the net debt amounted to €3,427 million, compared with €3,044 million as of December 31, 2024. This change mainly takes into account the net balance of disposals (acquisitions) of subsidiaries and affiliates for a negative net amount of -€64 million, dividends payments for -€586 million (-€534 million in the first half of 2024) and new lease liabilities for -€118 million (-€95 million in the first half of 2024).

Shareholders’ equity, Group share amounted to €7,138 million, compared with €7,515 million as of December 31, 2024. This evolution reflects the positive contribution of net income from continuing operations, Group share (+€664 million) less the dividend paid (-€586 million).

Outlook

The robust sales performance in the first half, driven by the strength of the Avionics and Defence businesses, allows the Group to raise its annual organic sales growth target.

The commercial momentum in the second half is also well oriented as Thales continues to benefit from favorable prospects in the vast majority of its markets in the short, medium and long term.

Thales confirms its expectation of a solid increase in Adjusted EBIT margin, mainly driven by the margin progression in the Aerospace segment and continued high margin in Defence.

The Group still anticipates a contained direct impact of tariffs based on the information available as of July 23, 2025. Thus, the 2025 guidance assumes reciprocal tariffs of 10% from Europe and 25% from Mexico, and exclude any retaliatory measures that might be taken by Europe in this context.

Assuming no new disruption in the macroeconomic and geopolitical contexts, and assuming the aforementioned assumptions regarding tariffs, Thales upgrades its sales organic growth target for 2025 and confirms its other targets:

- An unchanged book-to-bill ratio above 1;

- An expected organic sales growth between +6% and +7%, versus to +5 to +6% previously, corresponding to a sales range of €21.8 to €22.0 billion13;

- An Adjusted EBIT margin between 12.2% and 12.4%.