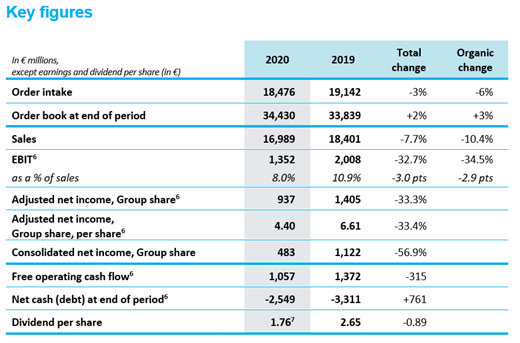

Order intake: €18.5 billion, down 3% (-6% on an organic basis1)

· Sales: €17.0 billion, down 7.7% (-10.4% on an organic basis)

· EBIT:2 €1,352 million, down 33% (-34% on an organic basis)

· Adjusted net income, Group share:2 €937 million, down 33%

· Consolidated net income, Group share: €483 million, down 57%

· Free operating cash flow:2 €1,057 million, 113% of adjusted net income, Group share

· Dividend3 of €1.76, payout ratio of 40% confirmed

· 2021 objectives:

o Book-to-bill4 above 1, supporting sales growth acceleration from 2022

o Sales between €17.1 billion to €17.9 billion

o EBIT margin between 9.5% to 10%

Thales’s Board of Directors (Euronext Paris: HO) met on 3 March 2021 to review the 2020 financial statements.[5]

“Logically, full-year 2020 results were heavily impacted by the Covid-19 crisis. The efforts of our teams all over the world have demonstrated the Group’s human and economic resilience as well as its agility. We are therefore far exceeding the objectives of our global adaptation plan.

In this unprecedented context of global pandemic, I would like to reiterate my gratitude to all Thales teams for their exemplary commitment and to our customers and partners for their trust.

The second half of 2020 showed a strong recovery in terms of both order intake and profitability. The EBIT margin before restructuring costs returned to the H2 2019 level.

Furthermore, 2020 cash generation was once again very strong. It illustrates both the robustness of our civil-defense business model and our teams’ focus on operational performance.

Our digital strategy, bolstered by our position as a leader in cybersecurity, is bearing fruit across all of the Group’s businesses, with great commercial successes in space, defense, rail signaling and data protection.

In a still uncertain economic and health environment, our unique position combining a world-class technological portfolio and comprehensive expertise in our 5 major markets will enable us to swiftly regain our profitable growth momentum.”

Patrice Caine, Chairman and Chief Executive Officer

Key figures

Key figures FY2020

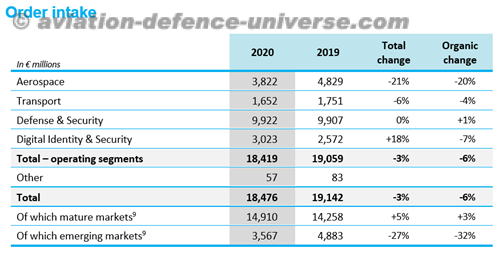

Order intake in 2020 totaled €18,476 million, down just 3% from 2019 (-6% on an organic basis, i.e., at constant scope and exchange rates). As expected, after the delays in finalizing contracts in the second and third quarters of 2020 due to the public health crisis, the Group benefited from a particularly strong momentum in the fourth quarter in the Defense & Security segment. At 31 December 2020, the consolidated order book stood at €34.4 billion, an all-time record.

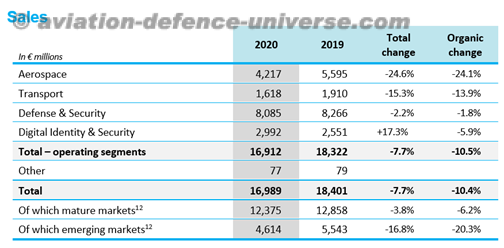

Sales came in at €16,989 million, down 7.7% from 2019, and down 10.4% at constant scope and exchange rates. The decline in sales was primarily due to the collapse in civil aeronautics demand (by approximately -50%) and disruptions affecting operations across all Group businesses.

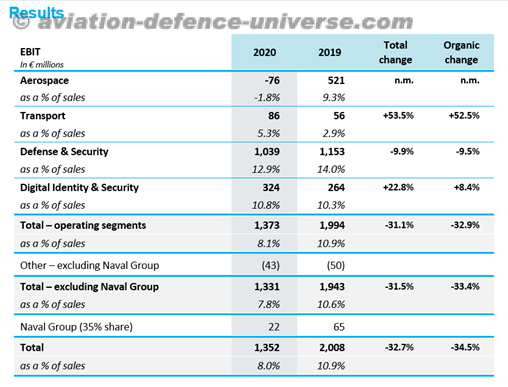

In 2020, consolidated EBIT was €1,352 million (8.0% of sales), compared with €2,008 million (10.9% of sales) in 2019, a drop of 32.7% (-34.5% on an organic basis).

From early April 2020, Thales implemented a global adaptation plan to the crisis in order to maintain its production capacity at the service of its customers, limit the industrial and financial impact of this crisis and strengthen its funding capacity in the event that the crisis persisted or worsened. The plan generated estimated P&L savings of around €850 million for the year and reduced operating investments by 25% at constant scope.

At €937 million, adjusted net income, Group share was down 33%, in line with the decrease in EBIT.

Consolidated net income, Group share stood at €483 million, down 57% from 2019.In addition to the decrease in adjusted net income, this change was caused by a reduction in income from disposals and the recognition of an impairment loss on goodwill and intangible assets in the civil aeronautics business (In-Flight Entertainment).

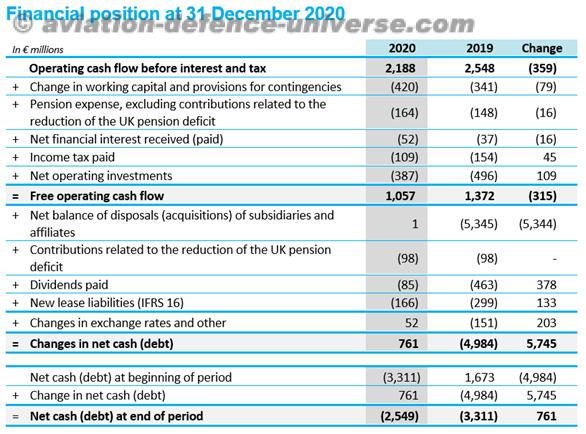

Free operating cash flow[8]amounted to €1,057 million versus €1,372 million in 2019. As a result, the cash conversion ratio of adjusted net income, Group share, to free operating cash flow was 113% (98% in 2019). This solid performance was mainly due to the measures taken since 2019 under the “Cash” initiative and the cash effects of the global adaptation plan to the crisis.

In this context, the Board of Directors decided to propose the payment of a dividend of €1.76 per share, corresponding to a payout ratio of 40% of adjusted net income, Group share.

Order intake

Order intake FY2020

Order intake in 2020 amounted to €18,476 million, down 3% from 2019 (-6% at constant scope and exchange rates[10]). The book-to-bill ratio was 1.09 versus 1.04 in 2019, and even 1.10 when excluding the Digital Identity & Security segment, whose order intake is structurally very close to sales.

Thales received 19 large orders with a unit value of over €100 million, representing a total of €5,052 million:

· 1 large order booked in Q1 2020 for an air surveillance system for a Middle Eastern country

· 3 large orders booked in Q2 2020:

o the supply of anti-submarine sonars to the US navy (Defense & Security segment)

o a 10-year contract guaranteeing the supply of munitions to the Australian army (Defense & Security segment)

o the construction of 2 telecommunications satellites for SES (Aerospace segment)

· 2 large orders received in Q3 2020, both in the Defense & Security segment:

o a new tranche of the Scorpion program pertaining to the delivery of armored vehicles to the French Army

o a support and services contract of the ATL 2 for the French Army in a partnership with Dassault Aviation

· 13 large orders booked in Q4 2020:

o the development contract for Space Rider, Europe’s future unmanned, autonomous and reusable space transportation system (Aerospace segment)

o additional work on the Exomars 2020 mission and the ground segment and security center for the Galileo constellation (Aerospace segment)

o the development of Europe’s first digital railway signaling “node” on behalf of the Deutsche Bahn (Transport segment)

o the construction of the ground segment for Syracuse IV, the French Armed Forces’ next-generation satellite communications system (Defense & Security segment)

o 2 projects on the French Army’s encrypted networks (Defense & Security segment)

o the production of 8 unmanned mine countermeasure systems under the joint Franco-British MMCM program (Defense & Security segment)

o the supply and integration of the mission and combat system, a multifunction radar and the AWWS system on the German Navy’s four new F126 multi-mission frigates (project formerly known as MKS 180, Defense & Security segment)

o the acquisition of an air surveillance system by a Middle Eastern country

o an in-service support contract for the TALIOS and DAMOCLES pods for the French Army (Defense & Security segment)

o a support contract for the British Army’s short-range air defense systems (Future ADAPT, Defense & Security segment)

o a contract for the assembly and integration of remote weapon stations and shot detection systems on the British Army’s Boxer vehicles (MIV project, Defense & Security segment).

Orders with a unit value of less than €100 million were down 8% from 2019 to €13,424 million (-13% at constant scope). Avionics orders with a unit value of less than €10 million recorded a sharp decline (-42% at constant scope), as well as in passport production (Digital Identity & Security segment), a direct consequence of the public health crisis.

Geographically,[11] order intake in emerging markets amounted to €3,567 million, down 32% at constant scope and exchange rates. At €14,910 million, order intake in mature markets remained high (+3% at constant scope and exchange rates), driven primarily by the booking of 12 large defense contracts in 5 countries.

Order intake in the Aerospace segment totaled €3,822 million versus €4,829 million in 2019 (-20% at constant scope and exchange rates). This decline was driven by the collapse of civil aeronautics orders (Avionics and In-Flight Entertainment) since the beginning of the public health crisis. Thales Alenia Space recorded strong orders in Earth observation and space exploration. In accordance with space agency contracting practices, initial orders for such projects generally cover early project phases (so-called “advanced definition”) and involve limited amounts. Consequently, order intake for the space business was down for the year (-5% at constant scope and exchange rates). At 31 December 2020, the segment’s order book stood at €6.6 billion, down 10%.

At €1,652 million, order intake in the Transport segment was down 4% from 2019 at constant scope and exchange rates. This change reflects solid momentum in mainline rail, most notably with the booking of a large order from the Deutsche Bahn, offset by order delays in the urban rail business. At 31 December 2020, the segment’s consolidated order book was down 4% to €3.9 billion.

At €9,922 million (compared with €9,907 million in 2019), order intake in the Defense & Security segment set a new record (+1% at constant scope and exchange rates). The book-to-bill ratio was 1.23 versus 1.20 in 2019 and 1.09 in 2018. The reason for this high level was the booking of 14 contracts with amounts greater than €100 million, including a major contract in Germany worth more than €1.5 billion: the MKS 180 project. This contract, one of the largest ever signed by Thales, represents a key step in the development of the European defense industry and further underpins Thales’s leading international position in naval system integration. The segment’s order book totaled €23.2 billion, or 2.9 years’ worth of sales, strengthening visibility for the years ahead.

At €3,023 million, order intake in the Digital Identity & Security segment was very close to sales, as most business lines in this segment have short sales cycles. The segment therefore does not have a meaningful backlog.

Sales

Sales FY2020

2020 sales stood at €16,912 million, compared with €18,322 million in 2019, down 7.7% after the integration of Gemalto. The organic change (at constant scope and exchange rates[13]) was -10.4%, with more than 70% of the H2 decrease (on an organic basis) caused by the collapse in demand in the civil aeronautics segment.

Geographically,[14]the decline in sales was more marked in emerging markets (-20.3% on an organic basis), reflecting anticipated phasing effects on a few large contracts, especially in transport, after several years of strong growth.The decline was more moderate in mature markets (-6.2% on an organic basis), despite the major drop in civil aeronautics business in France.

Sales in the Aerospace segment amounted to €4,217 million, down 24.6% from 2019 (-24.1% at constant scope and exchange rates). This drop reflects the collapse in civil aeronautics demand (by around 50% since Q2 2020) and the deferral of tenders in the space business due to the Covid-19 crisis.

In the Transport segment, sales totaled €1,618 million, down 15.3% compared to 2019 (-13.9% at constant scope and exchange rates). The decline was due to disruptions caused by the public health crisis, especially delays in signing contracts that would have generated sales in the second half of 2020, in addition to the phasing down effects on major urban rail signaling contracts (particularly in Doha and London), which have been weighting on the segment’s growth since the end of 2018.

Sales in the Defense & Security segment totaled €8,085 million, down 2.2% compared to 2019 (-1.8% at constant scope and exchange rates). The segment benefited from a significant catch-up effect in the second half of the year, with sales up 3.2% on an organic basis. This return to growth attests to the solid momentum of the Group’s solutions: at end December 2020, this segment had a record backlog of more than €23 billion.

In the Digital Identity & Security segment, sales were down 5.9% to €2,992 million at constant scope and exchange rates.This decline was due to the adverse impact of the public health crisis on passport demand starting in the second quarter and on IoT connectivity modules in the second quarter. Sales of EMV payment cards and SIM cards, which were better than expected in the first half of the year, were unsurprisingly down in the second half, impacted by an unfavorable basis of comparison.

Results

Results FY2020

In 2020, consolidated EBIT[15] was €1,352 million, or 8.0% of sales, versus €2,008 million (10.9% of sales) in 2019.

The global adaptation plan to the crisis generated estimated savings of approximately €850 million for the year, €100 million above target.

The Aerospace segment posted negative EBIT of €76 million (-1.8% of sales), versus a positive EBIT of €521 million (9.3% of sales) in 2019. The deterioration in this sector’s margin was due to the impact on gross margin of the collapse in civil aeronautics sales and the increase in restructuring costs, which was partially offset by the savings from the global adaptation plan. After a first half that was severely impacted by the health crisis, the space business posted an EBIT margin during the second half of the year that was higher than its H2 2019 EBIT margin.

EBIT for the Transport segment was up sharply to €86 million (5.3% of sales), compared to €56 million (2.9% of sales) in 2019. Despite the Covid-19 crisis, the actions implemented as part of the segment’s transformation plan resulted in an EBIT margin increase in line with medium-term objectives (an EBIT margin of 8% to 8.5%).

In the Defense & Security segment, EBIT stood at €1,039 million, versus €1,153 million in 2019 (-9.5% at constant scope and exchange rates). Segment margin was 12.9% versus 14.0% in 2019 (which included approximately €40 million in positive one-off items). This solid EBIT margin, which was at the top of the target medium-term range (12% to 13%) despite the negative impact of Covid-19 crisis-related operational disruptions, demonstrates the segment’s resilience. This solid performance was achieved thanks to continued sales momentum, the positive impact of competitiveness initiatives and high-quality project execution.

At €324 million (10.8% of sales), EBIT in the Digital Identity & Security segment increased in line with the business plan.The segment enjoyed higher-than-expected cost synergies and benefited from good indirect cost management under the Group’s global adaptation plan and the leverage effect on EMV and SIM card sales in the first half.

At €22 million in 2020 versus €65 million in 2019, Naval Group’s contribution to EBIT was down, as a direct consequence of the impact of the public health crisis on its business.

The increase in net financial interest (-€60 million versus -€43 million in 2019) was mainly due to the increase in average net debt. Other adjusted financial income16 (-€34 million in 2020 versus -€12 million in 2019) was primarily impacted by higher foreign exchange losses. The change in adjusted financial expense on pensions and other long-term employee benefits16 (‑€41 million compared with ‑€56 million in 2019) was due to the sharp decline in discount rates in 2019.

As a result, adjusted net income, Group share16 was €937 million versus €1,405 million in 2019, after an adjusted income tax charge16 of ‑€264 million, compared with ‑€454 million in 2019. The decrease in the tax rate in France reduced the effective income tax rate to 23.1% in 2020 from 26.3% in 2019.

Adjusted net income, Group share, per share16 came out at €4.40, down 33% from 2019 (€6.61).

Consolidated net income, Group share stood at €483 million, down 57% from 2019.In addition to the decline in adjusted net income, this decrease was due to the reduction in income from disposals and the recognition of an impairment loss on goodwill and intangible assets in the civil aeronautics business (in-flight entertainment).

Financial position at 31 December 2020

Financial position at 31 December 2020

Free operating cash flow[17]amounted to €1,057 million versus €1,372 million in 2019. As a result, the cash conversion ratio of adjusted net income, Group share, to free operating cash flow was 113% (98% in 2019). This solid performance was mainly due to the measures taken since 2019 under the “Cash” initiative and the cash effects of the global adaptation plan to the crisis, which included a 25% reduction in net operating investments at constant scope. The Group also benefited from initiatives taken by certain institutional and government customers to shorten their payment terms and from a phasing effect on prepayment for large contracts that was not as negative as expected.

At 31 December 2020, net debt amounted to –€2,549 million, versus -€3,311 million at 31 December 2019, after taking into account new lease liabilities totaling €166 million (€299 million in 2019) and after the payment of €85 million in dividends (€463 million in 2019).

Shareholders’ equity, Group share totaled €5,115 million, versus €5,449 million at 31 December 2019, with consolidated net income, Group share (€483 million) failing to offset the increase in net pension obligations (€641 million).

Proposed dividend

At the Annual General Meeting on 6th May 2021, the Board of Directors will propose the distribution of a dividend of €1.76 per share. This level corresponds to a payout ratio of 40% of adjusted net income, Group share.

If approved, the ex-dividend date will be 18th May 2021 and the payment date will be 20th May 2021. The dividend will be paid fully in cash and will amount to €1.36 per share, after deducting the interim dividend of €0.40 per share paid in December 2020.

Outlook

The Covid-19 health crisis continues to affect the global environment. While it is expected to improve during the year, the public health and macro-economic context remains highly uncertain in the short term and could affect the pace of air traffic recovery and corporate investment plans.

Thales will continue to implement all the levers of its Ambition 10 strategic plan, designed to generate profitable and sustainable growth, combined with the structural adaptation plan in its civil aeronautics-exposed businesses, which will be impacted by this crisis over several years.

The Group will also benefit from the visibility provided by its order book of over €31 billion, from positive trends in most of its markets and from the acceleration of its growth initiatives.

Consequently, assuming an economic and public health situation that does not experience any new major disruptions, and a normalization of the global semiconductor supply chain, Thales has set the following 2021 objectives:

· As in 2019 and 2020, a book-to-bill ratio above 1;

· Sales in the range of €17.1 billion to €17.9 billion,18 taking into account the significant ongoing disruptions in civil aeronautics and the recovery of growth in the other segments;

· An EBIT margin in the range of 9.5% to 10%, up 150 to 200 basis points from 2020, thanks to the full effect of the global crisis adaptation plan, ongoing Ambition 10 competitiveness initiatives and the further ramp up of Gemalto-related cost synergies.

Finally, the strong delivery of cash flow maximization initiatives allows the Group to upgrade its free cash flow generation target for the 2019 to 2023 period: the cash conversion ratio should reach around 95% on a reported basis.