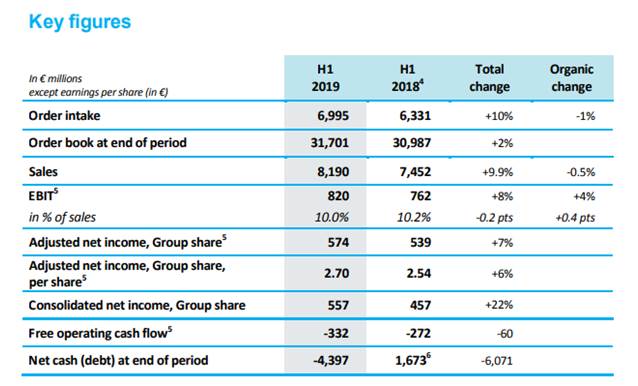

Order intake: €7.0 billion, up 10% (-1% on an organic basis )

- Sales: €8.2 billion, up 9.9% (-0.5% on an organic basis)

- EBIT : €820 million, up 8% (+4% on an organic basis)

- Adjusted net income, Group share: €574 million, up 7%

- Consolidated net income, Group share: €557 million, up 22%

- Free operating cash flow: -€332 million

- All 2019 financial objectives confirmed, with organic sales growth at the lower end of the previous guidance (3% to 4%)

Thales’s Board of Directors (Euronext Paris: HO) met on 3 September 2019 to review the financial statements for the first half of 2019.

“In the first half of 2019, Thales posted a solid performance, once again demonstrating the resilience of its business model. In spite of the slowdown in the commercial space market as well as a high basis of comparison in the Transport and Defence & Security segments, sales remained stable at constant scope and currency. The commercial momentum remained solid, with the booking of 7 large orders with a unit value of more than €100 million. Operating margin grew organically, led by a very good performance in the Defence & Security segment. The results achieved by Gemalto, consolidated since 1 April 2019, were in line with our expectations. This positive momentum allows us to confirm our 2019 financial objectives.

All Group teams remain focused on the implementation of the second phase of Ambition 10, our strategic plan, and on Gemalto’s integration.” Patrice Caine, Chairman & Chief Executive Officer.

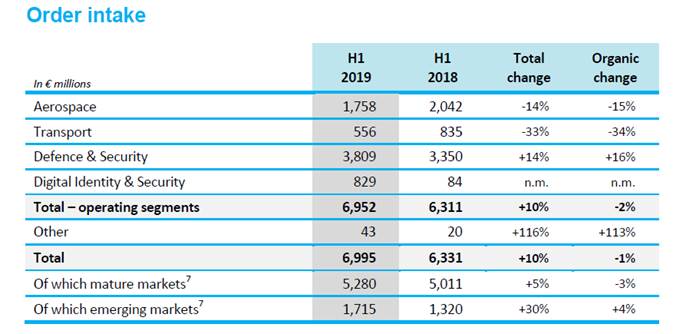

H1 2019 order intake amounted to €6,995 million, up 10% compared to H1 2018 (-1% at constant scope and currency), driven by a solid momentum in the Defence & Security segment. At 30 June 2019, the consolidated order book stood at €31.7 billion, which represents 1.9 years of sales.

Sales stood at €8,190 million, up 9.9% compared to the first half of 2018 following the consolidation of Gemalto, and down slightly (-0.5%) at constant scope and currency.

In the first half of 2019, the Group posted EBIT of €820 million (10.0% of sales), compared to €762 million (10.2% of sales) in H1 2018, up 8%. EBIT margin increased by 0.4 points at constant scope and currency. The slight dip in the reported margin is due to the consolidation of Gemalto, whose profitability is more seasonal than the rest of the Group.

At €574 million, adjusted net income, Group share grew by 7%, in line with the increase in EBIT.

Consolidated net income, Group share stood at €557 million, up 22% compared to H1 2018, with the capital gains made on the disposal of the GP HSM business (€221 million) offsetting the fall in income from operations (-€125 million) arising from the accounting entries (PPA) related to Gemalto’s acquisition.

At –€332 million, H1 2019 free operating cash flow was negative, reflecting the seasonal nature of the WCR. Net debt stood at €4,397 million at 30 June 2019, following the acquisition of Gemalto and the application of IFRS 16.