Pune. 25 January 2024. Tata Technologies Limited (BSE: 544028, NSE: TATATECH), announced financial results for the quarter ended December 31, 2023.

Resilient performance in a seasonally soft quarter

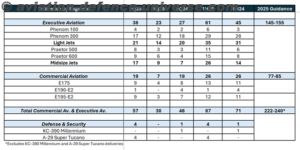

- Total operating revenue up 14.7% YoY and up 1.6% QoQ to ₹12,895 million.

- In USD terms, total operating revenues were up 0.9% QoQ and up 13.4% YoY to $154.8 million. Services segment revenues were up 8.3% YoY to $120.2 million.

- In constant currency, Services revenues were up 5.8% YoY.

- Continued improvement in the customer ramp-up activity, with 39 customers now in the million-dollar plus revenue bucket compared with 34 at the end of Q3 FY23.

- Operating EBITDA at ₹2,366 million. Operating EBITDA margin at 18.3%, a 140-bps increase QoQ driven by improved Services gross margins.

- Net income at ₹1,702 million; Net margin at 13.2%.

- Net headcount addition of 172; Workforce strength of 12,623

- 180 bps sequential improvement in [LTM] attrition to 15.4%.

Warren Harris, Chief Executive Officer and Managing Director, said: “We delivered sequential growth and a healthy operating EBITDA margin at 18.3% in Q3FY24 while making strategic investments in relationships to enable future growth. Our deal win momentum has stayed robust, with 5 large deals won in the quarter, including one deal with over $50 million in TCV and another one with $25 million in TCV. We remain positive on customer spending in the Automotive vertical as OEMs continue to pivot towards electrification and other alternative propulsion systems. The Aerospace industry is looking upbeat, with a good pickup in demand there. We are investing in building capabilities at scale and remain confident about the long-term fundamentals of our business. We have seen our employee engagement initiatives yield success with a steady reduction in attrition levels over the last few quarters. We continue to focus on engineering a better world for our customers, employees, partners and the community.”

Savitha Balachandran, Chief Financial Officer, said: “We continue to maintain a sharp focus on profitability and cash flow generation in our business. Despite the seasonally soft quarter, our margins have remained resilient reflecting strong operational rigor and execution. Our long-term levers of margin growth include increased offshoring, further improvement of our people pyramid and operating leverage as our business scales. The free cash flow to net income conversion in the first nine months of the year has also remained robust.”

Key highlights and recognitions:

- A leading global automotive OEM has onboarded Tata Technologies as its strategic engineering partner for “FTE Engineering Services” engagement.

- A leading European luxury automotive OEM has chosen Tata Technologies for the design, development, implementation and validation of AUTOSAR-based software for DRVU ECU (Gateway Module).

- A leading Aerospace OEM has chosen Tata Technologies for M&T engineering engagement.

- Tata Technologies won a large engagement with a North American automotive OEM for the implementation of SAP and PLM-managed services.

- A leading Asian automotive OEM has chosen Tata Technologies for the development of a premium crossover sedan.

- As Per Zinnov Zones 2023, Tata Technologies was rated 1st among all India-based global Automotive Engineering Service Providers and 3rd among global Automotive Engineering Service Providers. Tata Technologies is also ranked 1st among all India-based global Engineering Service Providers and is among the top 2 globally, in electrification. Tata Technologies was also ranked in the Leadership Zone for Aerospace and Industry 4.0.