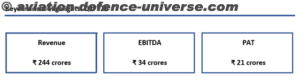

For the full year, revenues marginally dipped by 1.4 % to Rs 8,844 Crores as against 8,969 Crores in FY24. EBITDA at Rs 2,524 Crores (EBITDA margins of 28.5%) and PBT at Rs 1,972 Crores saw a marginal improvement as compared to FY24. Balance sheet remained robust with cash on books of Rs 2,623 Crores.

At a consolidated level, revenues remained flat at Rs 15,123 Crores as against Rs 15,682 Crores in FY24. EBITDA margins improved from 16.4% to 18.2%.

During the quarter the company secured new orders worth Rs 4,343 Crores including Rs 3,417 Crs towards the ATAGS order. As of March 2025, the defence order book stood at Rs 9,420 Crores. Bharat Forge group secured new orders worth Rs 6,959 Crore in FY25 with Defence accounting for 70% of those.

The ferrous castings business has had a strong year with revenues growing by 23%, EBITDA by 35% and doubling of profits as compared to FY24 with key return ratios exceeding 20%. As JSA continues to gain market share in the small casting segment, it is also embarking on a path to expand their product offerings and enhance their productivity to deliver strong operating leverage.

For FY26, company’s focus will be on improving the consolidated profitability driven by the following internal actions; reducing losses in the E-Mobility vertical; evaluating options for the steel business in Europe; improving operational performance in the Aluminum business leading to meaningful reduction in losses; leveraging our manufacturing footprint in North America to garner new business; focus on new business wins in traditional forgings, Defence, Aerospace & castings business to ensure continuation of momentum. The integration of AAM India business will occur in FY26 and Bharat Forge will leverage that platform to further our product portfolio and presence in India.