Boston. 23 April 2024. GE Aerospace announced results for the first quarter ending March 31, 2024. The consolidated results below include the operations of GE Vernova Inc. (“GE Vernova”), which successfully separated in a spin-off after quarter-end on April 2, 2024 and will report its results on April 25, 2024.

First quarter 2024 GE Consolidated Results (including GE Aerospace and GE Vernova):

- Total orders of $20.1B, +14%; organic orders +14%

- Total revenue (GAAP) of $16.1B, +11%; adjusted revenue* $15.2B, +10% organically*

- Profit margin (GAAP) of 6%, (3,320) bps; adjusted profit margin* 10.2%, +300 bps organically*

- Continuing EPS (GAAP) of $1.38, $(4.18); adjusted EPS* $0.82, +$0.55

- Cash from Operating Activities (GAAP) of $1.0B, +$0.9B; free cash flow* $0.9B, +$0.7B

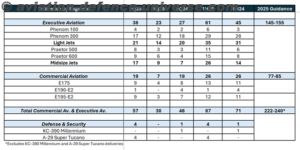

First quarter 2024 GE Aerospace Results (on a standalone basis)1:

- Total orders of $11.0B, +34%

- Adjusted revenue* $8.1B, +15%

- Operating profit* $1.5B, +24%

- Operating profit margin* 1%, +140 bps

- Free cash flow* $1.7B, +$0.8B

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. said, “We marked a new beginning in early April with the successful spin-off of GE Vernova and launch of GE Aerospace, completing our multi-year transformation. Our teams achieved this milestone while delivering strong results in the first quarter led by significant profit and cash growth at GE Aerospace.”

Culp continued, “At GE Aerospace, Commercial Engines & Services and Defense & Propulsion Technologies drove double-digit revenue, profit and free cash flow growth in the quarter. Given our solid start to the year and outlook for the remainder of 2024, we are raising our full-year profit and free cash flow guidance. Moving forward as a focused global aerospace leader, we will continue to prioritize safety, quality, delivery, and cost — always in that order — while also investing in our future and driving long term profitable growth.”

GE Aerospace’s key actions included:

- Introduced FLIGHT DECK, the company’s lean operating model, accelerating its next stage of lean progress, ensuring focused execution, and bridging strategy to

- Hosted Investor Day outlining the company’s strategy to define flight today, tomorrow and for the future; its financial outlook targeting $10 billion in operating profit* by 2028; and its capital allocation framework, authorizing a $15 billion share buy-back program and raising its dividend, initiated in April at a 250%

- Announced plans to invest over $650 million in its manufacturing facilities and supply chain, including $550 million in US and international site upgrades and $100 million in the supply

- Reached an agreement at the Singapore Airshow with Thai Airways for GEnx-1B engines to power its new widebody fleet of 45 Boeing 787 aircraft and extended Cebu Pacific’s TrueChoice services agreement for their CFM56 engines. Secured a commitment from easyJet for more than 300 LEAP-1A engines and a services agreement from American Airlines for 400 LEAP-1B engines.

- Received an order for F414 engines to power additional KF-21 fighter jets for the Korean Air Force, continuing to build our international business, and finalized testing designs with Sikorsky Innovations for a hybrid electric vertical takeoff and landing

Total Company Consolidated Results

Including GE Aerospace and GE Vernova

Three months ended March 31

| Dollars in billions; per-share amounts in dollars, diluted | 2024 | 2023 | Year on Year |

| GAAP Metrics | |||

| Cash from Operating Activities (CFOA) | $1.0 | $0.2 | F |

| Continuing EPS | 1.38 | 5.56 | (75)% |

| Net EPS | 1.39 | 6.71 | (79)% |

| Total Revenue | 16.1 | 14.5 | 11 % |

| Profit Margin | 11.6 % | 44.8 % | (3,320) bps |

| Non-GAAP Metrics | |||

| Free Cash Flow (FCF)-a) | $0.9 | $0.1 | F |

| Adjusted EPS-b) | 0.82 | 0.27 | F |

| Organic Revenue | 15.1 | 13.7 | 10 % |

| Adjusted Profit-c) | 1.5 | 0.9 | 76 % |

| Adjusted Profit Margin-c) | 10.2 % | 6.4 % | 380 bps |

| Adjusted Organic Profit Margin-c) | 10.5 % | 7.5 % | 300 bps |

(a- Includes gross additions to PP&E and internal-use software. Excludes Insurance CFOA, separation cash expenditures and other items

(b- Excludes Insurance, non-operating benefit income, gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges and other items

(c- Excludes Insurance, interest and other financial charges, non-operating benefit costs, gains (losses) on retained and sold ownership interests and other equity securities, restructuring & other charges and other items, with Energy Financial Services (EFS) on a net earnings basis

In addition, GE:

- Completed the separation of GE Vernova on April 2,

- Received proceeds of $2.6 billion from the monetization of a portion of its shares in GE

- Repurchased approximately 1.1 million common shares for $0.1 billion in the first quarter under the company’s previously authorized $3 billion share repurchase

- Incurred pre-tax separation costs of $0.4 billion in the quarter, primarily related to employees, establishing standalone functions and IT systems, and professional