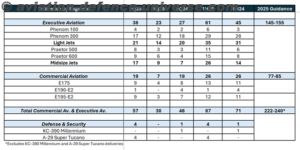

Montreal. 01 December 2020. CAE Inc. (“CAE” or the “Corporation”) completed its previously announced bought deal offering (the “Offering”) of common shares (the “Common Shares”), including the full exercise of the over-allotment option (the “Over-Allotment Option”), and private placement (the “Concurrent Private Placement”) of Common Shares for aggregate gross proceeds of approximately $495 million.

The syndicate of underwriters co-led by Scotiabank, RBC Capital Markets and TD Securities fully exercised the Over-Allotment Option to purchase an additional 1,509,000 Common Shares at the offering price of $29.85 per share. Including the exercise of the Over-Allotment Option, the Corporation sold an aggregate of 11,569,000 Common Shares for total gross proceeds of approximately $345 million.

In addition, the Corporation issued an aggregate 5,025,126 Common Shares, at a price of $29.85 per share, through the Concurrent Private Placement with a subsidiary of Caisse de dépôt et placement du Québec for aggregate gross proceeds of approximately $150 million.

Proceeds of the Offering and the Concurrent Private Placement will be used for general corporate purposes, including to fund future potential acquisition and growth opportunities, which includes the funding of the previously completed acquisition of Flight Simulation Company B.V. and the recently announced agreement to acquire TRU Simulation + Training Canada Inc. Pending such uses, CAE intends to invest the net proceeds from the Offering and Concurrent Private Placement, hold them as cash or cash equivalents, or repay indebtedness outstanding under its credit facilities, which may be withdrawn again as opportunities arise.