Business performance & Strategic Update- Q1FY26

- On a YoY basis, total revenue for the quarter grew by 9%; with core domains growing at 17%

- In core domains, aerospace revenue grew by 7%, defence revenue grew by 22% and ESAI revenue increased by 34%, as compared to Q1’25.

- Q1reflected significant order intake in defence vertical, which is expected to accelerate in the coming quarters as a result of enhanced procurement actions in Indian defence and global OEMs.

- The company has made significant progress in the development of facilities and infrastructure in line with its strategy to pivot towards product led nonlinear growth.

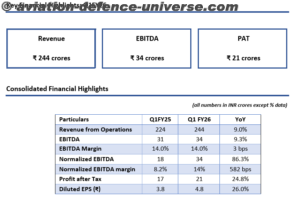

Financial Highlights – Q1 FY26

- Consolidatedrevenues for Q1’26 was at ₹244 crores, reflecting a growth of 9% YoY. Typically, H1 represents around 35% of full year revenue, with 65% recorded in H2, in view of the majority of defence revenues executed in H2. In dollar terms, revenue for the quarter amounted to $28.5 million, growing 6% YoY

- Reported EBITDA for the quarter was at ₹34 crores, representing an increase of 9% over ₹31 crores reported in Q1’25. However, normalizing Q1’25 EBITDA to ₹18 crores for one time write backs, Q1’26 EBITDA grew by 86%.

- EBITDA margin is at 14% for Q1’26, same as PY, and better by 582bps when compared to normalized EBITDA of 8.2% in Q1’25.

- Profit After Tax (PAT) of ₹21 crores grew by 25%, with a margin of 8.2% for the quarter, compared to ₹17 crores / 7.2% in Q1’25.

On the Strategic outlook for the business, Dr. Sampath Ravinarayanan, Chairman said: “It has now been nearly six months since I resumed the role of Chairman of your esteemed company. During this period, we have embarked upon a series of strategic initiatives designed to accelerate sustainable growth and position our organization for long-term success. I would like to highlight a few:

- We have set an ambitious target of achieving over 40% year-on-year growth across our core business domains.

- To drive non-linear growth, we are executing a strategic transition from a services-centric model toone focused on products and solutions, targeting a shift in our revenue mix to 20:80 services to product.

- We are investing in world-class infrastructure to support the development and delivery of these enhanced offerings.

- We have initiated the formation of mutually beneficial global partnerships in critical areas aligned with our strategic direction.

- We are rigorously reassessing activities that demonstrate stagnation or negative growth, or that no longer provide strategic value to the company.

- Our Power 930 Plan, aimed at achieving Rs. 9,000 Crore (1 Billion USD) in revenue by Fiscal 2030, is now underway.

I am pleased to inform you that dedicated leadership teams are now in place to oversee the implementation of these initiatives. This proven leadership group shares a unified vision and is deeply committed to realizing our collective objectives.

While we remain steadfast in our pursuit of delivering 40% growth in our core domains in the near term, we are simultaneously advancing the groundwork required for our broader transformation. As with any profound change, this process will take several quarters to mature, given the new pathways and teams involved.

Commenting on the performance, Mr. Alfonso Martinez; CEO & MD said that: – “In furtherance to robust performance in Q1 – our Orderbook and Forecast Visibility for FY26 and following years positions us for sustained and strong revenue growth of over 40%, with a targeted EBITDA margin of 19.5%. We are committed to topline growth of more than 25% and 300bps improvement in EBITDA for the current year.

To further strengthen our business, we are actively reassessing and refocusing activities that are currently loss-making or operating at lower margins.

We remain committed to delivering sustainable growth and long-term value for our shareholders and other stakeholders. Your continued trust and support are the foundation for our success, and I am confident that, together, we will achieve our ambitious goals in the years ahead.”