- Los Angeles, California, August 3, 2023 — Air Lease Corporation (ALC) (NYSE: AL) announces financial results for the three and six months ended June 30, 2023.

“Our second quarter results benefited from new aircraft deliveries exceeding our expectations, coupled with gains from higher volumes of aircraft sales. Lease rates continue to strengthen and demand for both aircraft leasing and sales remain robust, which we see continuing for the foreseeable future,” said John L. Plueger, Chief Executive Officer and President, and Steven F. Udvar-Házy, Executive Chairman of the Board.

Second Quarter 2023 Results

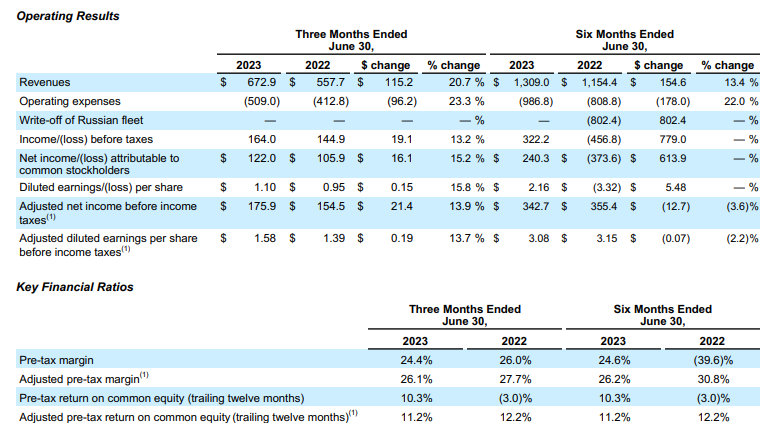

The following table summarizes our operating results for the three and six months ended June 30, 2023 and 2022 (in millions, except per share amounts and percentages):

Highlights

• Took delivery of 19 aircraft from our orderbook, representing approximately $1.5 billion in aircraft investments, ending the period with approximately $30 billion in total assets.

• Sold eight aircraft with a carrying value of approximately $600 million during the quarter, resulting in $45 million in gains from aircraft sales.

• As of August 3, 2023, we had aircraft with a carrying value of approximately $1.7 billion in our sales pipeline, which includes the 19 aircraft with a carrying value of $900 million classified as flight equipment held for sale as of June 30, 2023 and 22 aircraft with a carrying value of $800 million subject to letters of intent.

• Placed 100% of our contracted orderbook positions on long-term leases for aircraft delivering through the end of 2024 and have placed 58% of our entire orderbook.

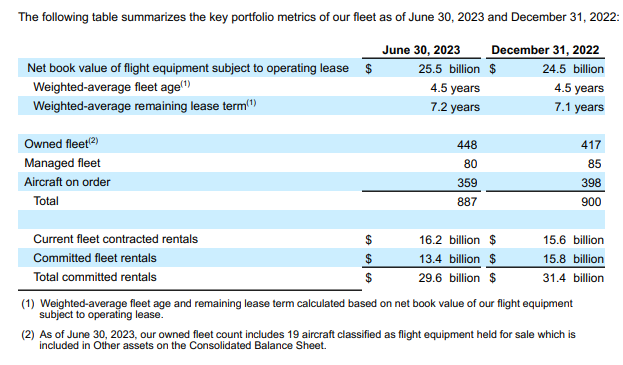

• Ended the quarter with $29.6 billion in committed minimum future rental payments consisting of $16.2 billion in contracted minimum rental payments on the aircraft in our existing fleet and $13.4 billion in minimum future rental payments related to aircraft on order.

• During the quarter, we entered into approximately $900 million in new financings. We ended the quarter with liquidity of $7.6 billion.

• On August 2, 2023, our board of directors declared a quarterly cash dividend of $0.20 per share on our outstanding common stock.

The next quarterly dividend of $0.20 per share will be paid on October 6, 2023 to holders of record of our common stock as of September 12, 2023.

Financial Overview

Our total revenues for the three months ended June 30, 2023 increased by 21% to $672.9 million as compared to the three months ended June 30, 2022. The increase in total revenues was primarily driven by the continued growth in our fleet and an increase in sales activity. The increase in aircraft sales, trading and other revenue was primarily related to the sale of eight aircraft which generated approximately $45

million in gains. We did not sell any aircraft for the three months ended June 30, 2022.

Our net income attributable to common stockholders for the three months ended June 30, 2023 was $122.0 million, or $1.10 per diluted share, compared to net income attributable to common stockholders of $105.9 million, or $0.95 per diluted share, for the three months ended June 30, 2022. Our adjusted net income before income taxes during the three months ended June 30, 2023 was $175.9 million or $1.58 per adjusted diluted share, as compared to $154.5 million, or $1.39 per adjusted diluted share, for the three months ended June 30, 2022. Net income attributable to common stockholders and adjusted net income before income taxes increased from the prior year period due to the growth of our fleet and increase in sales activity, partially offset by an increase in interest expense due to the increases in our composite cost of funds, increase in aircraft transition costs and increases in our aviation insurance expense in line with the growth of our fleet in the current year period.

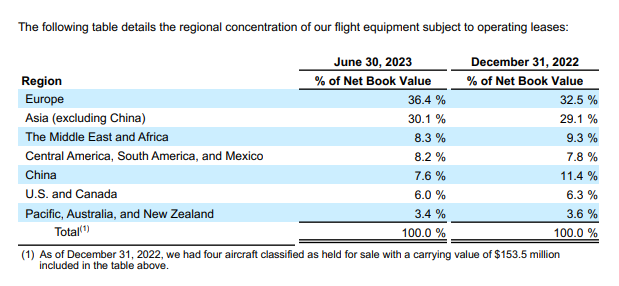

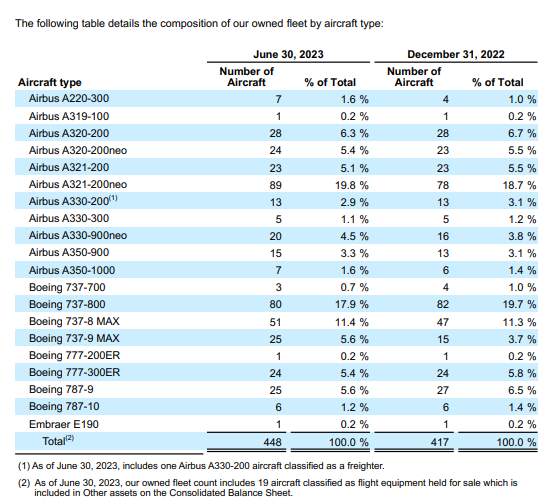

Flight Equipment Portfolio

As of June 30, 2023, the net book value of our fleet increased to $25.5 billion, compared to $24.5 billion as of December 31, 2022. As of June 30, 2023, we owned 448 aircraft in our aircraft portfolio, comprised of 332 narrowbody aircraft and 116 widebody aircraft, and we managed 80 aircraft. The weighted average fleet age and weighted average remaining lease term of flight equipment subject to operating lease as of June 30, 2023 was 4.5 years and 7.2 years, respectively. We have a globally diversified customer base of 118 airlines in 63 countries as of June 30, 2023.