Double-digit orders and revenue growth with positive free cash flow; raising low end of 2023 guidance

First quarter 2023:

- Total orders $17.6B, +25%; organic orders +26%

- Total revenues (GAAP) $14.5B, +14%; adjusted revenues* $13.7B, +17% organically*

- Profit margin (GAAP) of 8%, +5,410 bps; adjusted profit margin* 6.4%, +330 bps organically*

- Continuing EPS (GAAP) of $5.56, +$6.72; adjusted EPS* $0.27, +$0.36

- Cash from Operating Activities (GAAP) $0.2B, +$1.1B; free cash flow* $0.1B, +$1.3B

BOSTON — April 25, 2023 — GE (NYSE:GE) announced results today for the first quarter ending March 31, 2023.

GE Chairman and CEO and GE Aerospace CEO H. Lawrence Culp, Jr. said, “The GE team is off to an encouraging start in 2023, with our results reflecting robust market demand and our progress operating leaner and more focused businesses. In the first quarter, we delivered double-digit top-line growth with all segments up organically and continued strength in services, as well as margin expansion in all segments. And we reported our first positive free cash flow in the first quarter in nearly a decade.”

Culp continued, “At GE Aerospace, we are growing rapidly and supporting our customers amidst the pronounced commercial ramp. At GE Vernova, we are seeing continued signs of progress in Renewable Energy while Power is delivering solid growth. Overall, GE is creating significant value today and tomorrow as we prepare to stand up these leading franchises as independent companies sometime in early 2024.”

During the quarter, GE continued to take action on its priorities:

- Completed the spin-off of GE HealthCare into an independent publicly traded company, retaining an approximately 9% stake of GE HealthCare common stock.

- Named two new members to the GE Board of Directors with deep domain expertise in aerospace and energy, respectively: Darren McDew, retired General, S. Air Force, and former Commander of the U.S. Transportation Command, and Jessica Uhl, former Chief Financial Officer of Shell plc.

GE Aerospace

- Delivered double-digit growth in orders, revenue, and operating profit year-over-year driven by commercial momentum and strength in services, as the team improved LEAP output by 53% year-over-year and internal shop visits grew 32%.

- Reached agreement with Air India for the largest LEAP order to date with 800 engines, as well as 40 GEnx and 20 GE9X engines and related services agreements.

GE Vernova1

- Increased Renewable Energy orders by 94% and revenue* by 5% year-over-year organically led by Grid, as well as improved profit sequentially and year-over-year; and grew revenue* at Power by 11% year-over-year

- Reached agreements with TenneT to award GE-led consortiums with multi-billion Euro contracts for Grid Solutions’ High-Voltage Direct Current offering to support its 2GW programs in the Netherlands and

- Non-GAAP Financial Measure

1 GE’s portfolio of energy businesses

Total Company Results

We present both GAAP and non-GAAP financial measures to provide investors with additional information. We believe that providing these non-GAAP financial measures along with GAAP measures allows for increased comparability of our ongoing performance from period to period. Please see pages 5-7 for explanations of why we use these non-GAAP financial measures and the reconciliation to the most comparable GAAP financial measures.

Three months ended March 31

|

Dollars in millions; per-share amounts in dollars, diluted |

2023 | 2022 | Year on

Year |

| GAAP Metrics | |||

| Cash from Operating Activities (CFOA) | $155 | $(924) | F |

| Continuing EPS | 5.56 | (1.16) | F |

| Net EPS | 6.71 | (1.08) | F |

| Total Revenues | 14,486 | 12,675 | 14 % |

| Profit Margin | 44.8 % | (9.3)% | 5,410 bps |

| Non-GAAP Metrics | |||

| Free Cash Flow (FCF)-a) | $102 | $(1,169) | F |

| Adjusted EPS-b) | 0.27 | (0.09) | F |

| Organic Revenues | 13,929 | 11,919 | 17 % |

| Adjusted Profit-c) | 877 | 415 | F |

| Adjusted Profit Margin-c) | 6.4 % | 3.5 % | 290 bps |

| Adjusted Organic Profit Margin | 6.9 % | 3.6 % | 330 bps |

(a- Includes gross additions to PP&E and internal-use software. Excludes Insurance CFOA, separation cash expenditures, and other items (b- Excludes Insurance, non-operating benefit costs, gains (losses) on equity securities, restructuring & other charges, and other items

(c- Excludes Insurance, interest and other financial charges, non-operating benefit costs, gains (losses) on equity securities, restructuring & other charges, and other items, with EFS on a net earnings basis

In addition, GE:

- Reported GE HealthCare’s historical results and certain assets and liabilities included in the spin-off as discontinued operations, in connection with the separation of GE

- Repurchased approximately 3.2 million common shares for $0.3 billion during the first quarter, with $1.7 billion remaining under the GE Board’s prior authorization of common share repurchases of up to $3.0 In addition, the company redeemed 3.0 million GE Series D preferred shares for $3.0 billion.

- Completed the monetization of its remaining position in Baker Hughes for $0.2 billion and a portion of its position in AerCap with the sale of $1.8 billion in

- Incurred separation and related tax costs of $0.3 billion in the quarter, primarily related to business separation and employee costs, costs to establish standalone functions and information technology systems, professional fees, and other costs to transition to three standalone companies.

- Allocated certain postretirement benefit plans, effective January 1, 2023. Of the $6.9 billion pre-tax ($5.5 billion post-tax) plan deficit remaining with GE post-separation of GE HealthCare, $1.5 billion ($1.2 billion post-tax) was allocated to the Power and Renewable Energy plans and $5.4 billion ($4.3 billion post-tax) was allocated to the GE Aerospace

- Generated $54 million of net income from its run-off insurance operations in the quarter and completed the annual statutory cash flow The company funded $1.8 billion, as expected.

- Implemented the accounting standard for long-duration insurance contracts and converted to first principles As of December 31, 2022, the impact of the standard on GE’s after-tax equity was negative $2.7 billion. As of March 31, 2023, the impact of a lower discount rate resulted in a $1.1 billion after-tax reduction to equity.

- Recorded charges in discontinued operations of $0.2 billion related to its run-off Polish mortgage portfolio (Bank BPH). GE’s total litigation reserves related to this matter at March 31, 2023, were $1.5

- Non-GAAP Financial Measure

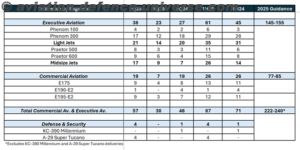

2023 Guidance

Based on first quarter business performance and market demand, GE is raising the low end of its full-year adjusted EPS* and free cash flow* ranges. The company now expects adjusted EPS* of $1.70 to $2.00 and free cash flow* of

$3.6 to $4.2 billion, up from adjusted EPS* of $1.60 to $2.00 and free cash flow* of $3.4 billion to $4.2 billion previously. GE continues to expect high-single-digit revenue growth* for 2023.