The highlights include:

- FY23: record contracts and rapidly growing cash receipts

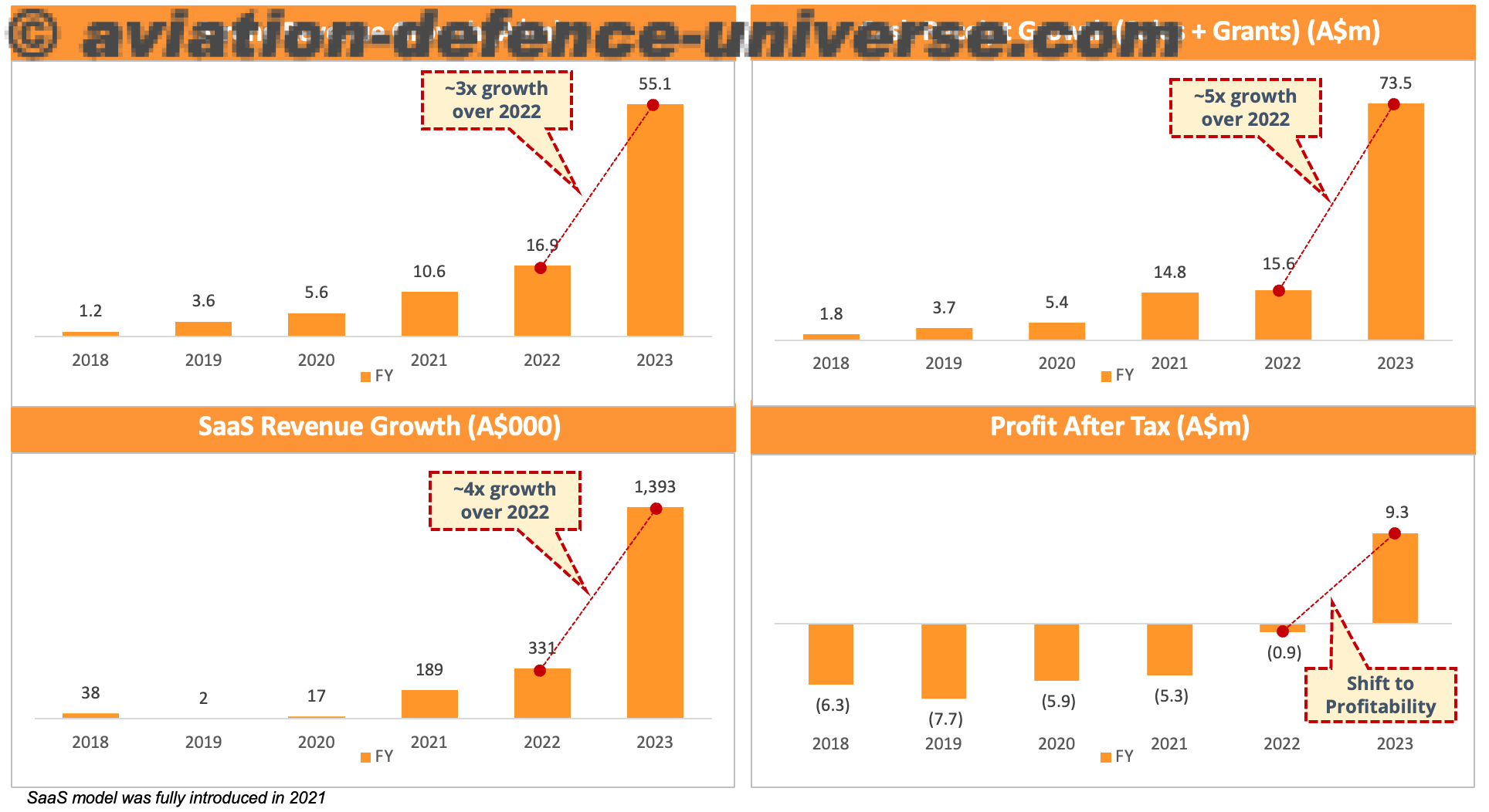

- FY23 $73.5 million cash receipts, up 5x vs. FY22

- FY23 $55.1 million revenue, up 3x vs. FY22

- 80% of revenues are from repeat customers

- The revenue vs. cash receipt difference mostly due to advanced payments on product subscriptions (SaaS), warranties, as well as grants received

- Largest geographical segment revenue contributions are US at 68% and Australia at 23%

- FY23 is first profitable year, with $9.3 million profit after tax

- Shareprice up 64% over 2023 (vs 9% for ASX300)

- Cash balance of $57.9 million as of 31 Dec 2023, no debt or convertibles

- Committed supply chain payments of $30 million

- $30 million contracted backlog and pipeline of over $510 million*

- Substantially completed expansion of the team to enable build, delivery and support of materially larger orders

- Completed move to a larger Sydney facility (3x current floor space) in January, plus supply chain partners been rapidly expanding

- No material cost to DRO to move, due to light capex model (heavy machinery work all outsourced) and landlord fitout incentive

payments - Positions the company for $300-400 million annual production capacity

- 115 team members including over 90 engineers

- Favourable environment for DroneShield with rapidly rising counter-drone, defence and security spending globally

- The Ukraine conflict continues to highlight the use of drones on the battlefield, which will continue driving increasing C-UAS orders even after the eventual ceasefire

- Drones increasingly used across global conflicts, including Hamas terror attack on Israel