- Revenue up by 18% to INR 6,996 Mn in 9MFY24

- EBITDA up by 5% to INR 980 Mn in 9MFY24

- PAT up to INR 244 Mn in 9MFY24

Bangalore. 15 February 2024. AXISCADES Technologies Ltd. announced results for the quarter and nine months ended December 31, 2023.

Performance Highlights (All numbers in INR Millions except % data)

| Particulars | Q3 FY24 | Q2 FY24 Q3 FY23 | Y-o-Y | Q-o-Q | 9M FY24 | 9M FY23 | Y-o-Y | ||||||

| Operating Revenue | 2,315 | 2,515 | 2,134 | 8% | -8% | 6,966 | 5,904 | 18% | |||||

| EBITDA | 292 | 358 | 296 | -1% | -18% | 980 | 936 | 5% | |||||

| EBITDA Margin | 12.6% | 14.2% | 13.9% | -124bps | -161bps | 14.1% | 15.8% | -177bps | |||||

| PAT | 75 | 112 | -102 | NA | -33% | 244 | -208 | NA | |||||

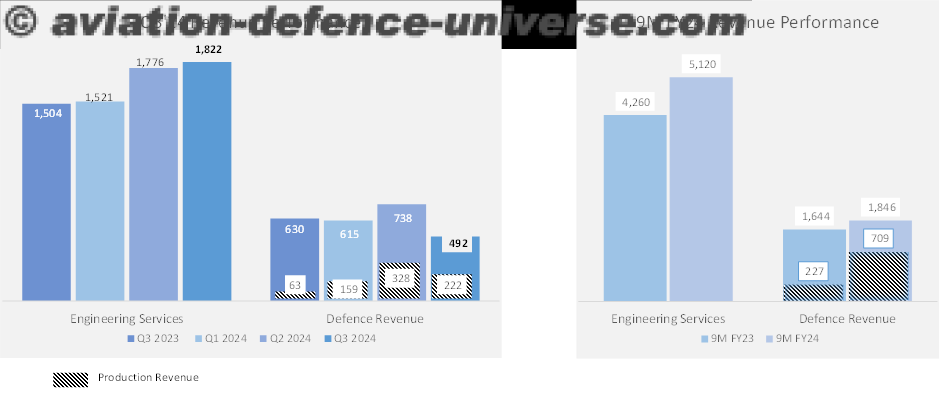

- Engineering Services Business in FY24, is showing consistent growth Q-o-Q. For 9M FY24, Engineering Services Business grew by 20%, as compared to previous year from INR 4,260 Mn to INR 5,120 Mn

- Defence, which constitutes, 26% of Company’s Revenue mix, always reflects Q-o-Q variability, typical to the industry, which impacts both enterprise consolidated revenue and profitability.

- Certain Production Orders in Defence were re-scheduled to Q4 FY24. As a result, Defence Production Revenues, which carry significantly higher margins, was lower in Q3 FY24 at INR 222 Mn, as against INR 328 Mn in Q2FY24.

- For 9MFY24, Defence Revenues Grew by 12% Y-o-Y from INR 1,644 Mn to INR 1,846 Mn. The Production Revenues in Defence, significantly increased, by 3X from INR 227 Mn to INR 709 Mn

- The Company’s PAT for Q3 FY24 stands at INR 75 Mn as against loss of INR (102) Mn in Q3 FY23. The Company’s PAT for 9M FY24 stands at INR 244 Mn against loss of INR (208) Mn in the previous year

Key Developments during the Quarter:

- The Company successfully concluded the Equity Raise of INR 220 Crores in January 2024, with marquee Institutional Investors subscribing to the issue. This will strengthen the balance sheet and improve profitability, in the coming periods

- Completed the acquisition of EPCOGEN Private Limited. This will aid in building a deeper presence in the energy vertical both with competency and array of customers and access to Middle East and North American energy markets

- Signed a strategic partnership with KANZEN Institute Asia-Pacific Pvt Ltd (KIAP), for new age Industry IIoT, Digital Automation and MES 4.0 implementation for delivering enhanced value to our Global customers.

Commenting on the performance, Mr. Abidali Neemuchwala, Chairman of AXISCADES said:

“AXISCADES delivered a Y-o-Y revenue growth, on the back of lumpiness in defence business and is poised to leverage on the investments made in strategic acquisitions and digital capabilities. Our recent Equity Raise of INR 220 Crores was a stupendous success, and will strengthen the balance sheet, improve profitability and will lead to growth and margin expansion. We are diversifying into new verticals, such as Energy and Automotive, through strategic acquisitions and thereby enhancing our capabilities, which will add to the depth of our offerings along with strong positioning in the global as well as domestic market. I am excited for the journey ahead for us and confident in our ability to realize our vision for AXISCADES as a Global Leader in Engineering and Technology solutions.”

Commenting on the results and outlook, Mr. Arun Krishnamurthi, CEO & MD of AXISCADES said

“We are delighted to report a broad-based performance in revenue and financial results. During the quarter, we saw higher contribution from Aerospace vertical, which grew by 27% Y-o-Y. The defence business during the quarter dropped due to its lumpiness, which is typical to the industry. The order book for coming quarters from the defence vertical remains strong. Our nascent entry into Energy and Automotive is gaining momentum, which will continue to grow in the coming quarters. During the quarter, we completed the acquisition of EPCOGEN, which will provide a strong impetus to the company’s growth in the Energy sector and provide access to Middle East and North American energy markets.

The proceeds of our recent Equity Raise, by way of Qualified Institutional Placement, attracted marquee Institutional Investors, which shows their confidence in the growth prospects of the Company. The proceeds of the equity raise will be utilized to repay borrowings and investing in developing new capabilities and building new partnerships to leverage on emerging technologies. We will continue to work on our objective to continue to generate long-term value for all our stakeholders.”