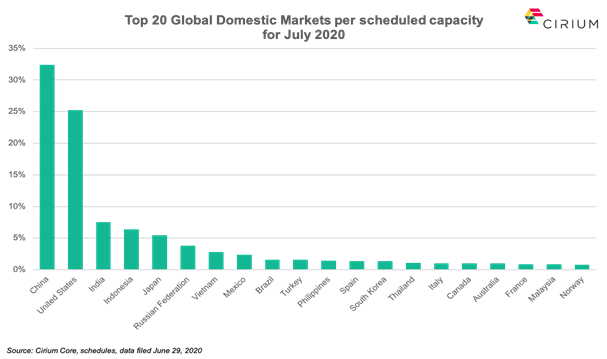

● Half of the top 20 global domestic markets* as per flights scheduled for July 2020 are Asia-Pacific countries including Australia, China, India, Indonesia, Japan, Malaysia, the Philippines, South Korea, Thailand and Vietnam.

● The US has the most domestic flights scheduled (413,538, 31.3%) for July 2020. China comes second (378,434, 28.7%) for the same month.

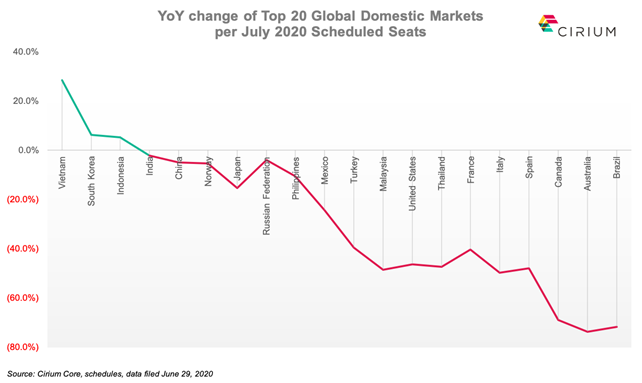

● Vietnam shows the most growth with domestic flights soaring by 28% YoY

Singapore. 10 July 2020. China and the US jostle to lead the world in domestic flights as air travel slowly resumes following a relaxation of travel restrictions, according to a new analysis from Cirium.

The travel data analytics expert reveals data which shows the domestic market recovery is leading the aviation sector’sglobal return, with China showing particular strength.

However, the US was the largest domestic market pre-COVID-19 globally, despite plunging 46% year-on-year in 2020, compared to 2019.

Domestic scheduled flights for July 2020 within the US still lead the world’s domestic aviation markets with 413,538 flights in total, compared to 378,434 flights within China. However, the US trails behind China when it comes to actual capacity on the flights being operated.

The fast-moving Chinese market shows almost 64 million seats scheduled for July 2020 on flights within China. This is a capacity slip of only 5% versus the same month last year, compared to the US capacity of over 47.4 million seats scheduled for the same month, which is still down a dramatic 46% versus July 2019.

The only markets globally to show growth in domestic travel are Vietnam, South Korea and Indonesia. Vietnam’s scheduled domestic flights and seats are up an impressive 28% compared to the same month last year.

The top 20 global domestic markets, per schedules for July 2020, account for more than 1.3 million flights in total, which has fallen by a third (32%) compared to 2019.

Of this top 20, Asia-Pacific countries account for 54% of the world’s total domestic flights, followed by North American countries at 33%, European countries with 9% and Latin American countries clocking in with just 4%.

Of the world’s 1.3 million scheduled domestic flights, 31% are in the US market, versus 29% for China.

Alistair Rivers, Cirium Director of Market Development – Airlines and Airports, said: “Cirium figures reveal a fragile but cautiously resurgent market, as the air travel attempts to recover from the worst collapse in its history, triggered by a fall in demand and the imposition of travel restrictions following the COVID-19 pandemic.”

“It is interesting to see China edging near the US, the previously dominant domestic market, and showing a return to similar levels of last year. However, the US has suffered a brutal 46% collapse versus July 2019,” said Rahul Oberai, Managing Director for APAC, Cirium.

“It’s also encouraging that other parts of Asia are showing a resurgence, with smaller markets such as Vietnam, South Korea and Indonesia showing positive YoY growth. Air travel activity is appearing to reflect the relative regional retreat and advance of COVID-19 cases globally. So, it’s not surprising to see Brazil, which is experiencing high levels of COVID-19 cases, experience a precipitous 71% YoY decline in capacity.”

A recent spike in COVID-19 cases in Melbourne, and the closing of the Victoria and New South Wales border, is mirrored with a 70% dive in Australian domestic flights scheduled for July 2020 compared to July 2019. The country also shows the biggest drop in the global top 20 with a massive 74% fall in domestic seats YoY.

Meanwhile India’s sizable domestic market is also showing the first signs of recovery with flights scheduled for July 2020 down just 4% compared to July 2019.

The COVID-19 crisis has seen a dramatic reduction in the amount of passenger flights scheduled globally. Previous analysis of Cirium’s schedules data indicated that global airline capacity was expected to drop by 75% by the end of April 2020, compared with the same period last year.

Almost two thirds of the entire global fleet – of around 26,300 passenger jets – were in storage at the height of the crisis. This has since risen with 59% of the world’s fleet now back in service, however meaning 41% are still in storage.